The share of the GBP/USD currency pair rebounded to the resistance level of 1.3833 to record the fourth consecutive day of gains. It settled around the 1.3815 level at the time of writing the analysis. Sterling's gains came as a natural response to the announcement of a daily decrease in virus cases for the fifth consecutive day. The UK recorded 29,173 new infections on Sunday, down from 48,161 last week. British Prime Minister Boris Johnson said that while the casualties were encouraging, the UK was "not out of the woods yet".

The prime minister warned that the effect of ending the legal restrictions was not yet visible.

Bank of England policymaker Gertjan Flegg noted that the current monetary stimulus should continue for at least several quarters, and possibly longer. “When the tightening becomes appropriate, I think not much of it will be needed, given the low level of the neutral rate,” he said in a speech to the London School of Economics.

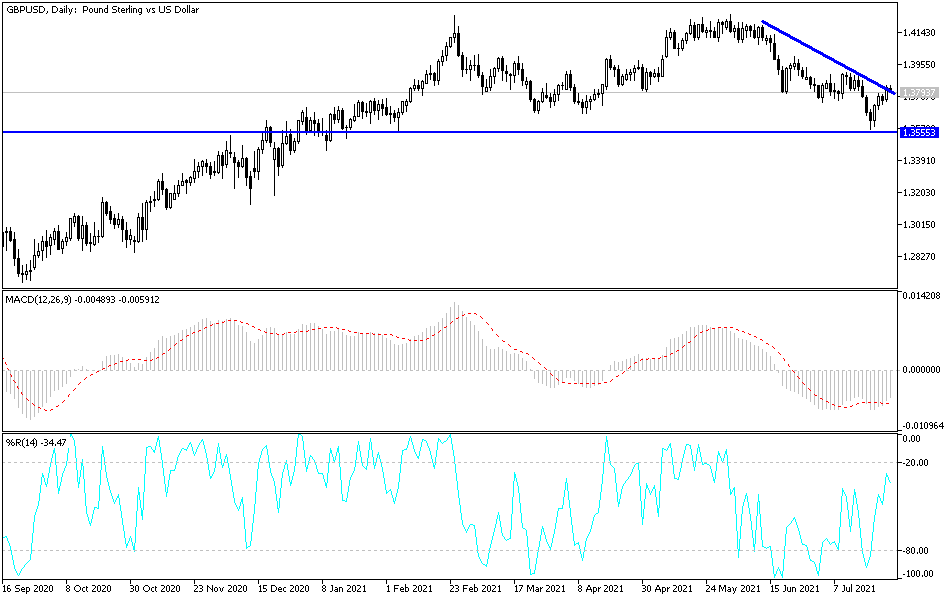

The exchange rate of the pound against the dollar fluctuated last week and now risks are becoming confined to a much lower trading range. Over the coming days the outcome depends on the market reading of the Fed's decision tomorrow Wednesday and the reaction from the results of other important economic data. According to the latest performance, the British pound fell briefly to a year-to-date loss against the dollar during an early sell-off last week and was unable to convincingly regain its ground before the weekend. This pushed the GBP/USD pair to open the new week a little below 1.3750 support.

Sterling now faces technical resistance around 1.3830 and a further rise at 1.3912 on any long-term bounce, which may require a bearish dollar reading for the looming Fed decision or US GDP and inflation numbers expected during the latter half of the week in order to materialize. Commenting on the future performance of the sterling dollar pair. “Above 1.3749 suggests that recovery could extend further to 1.3791, with 1.3830/40 levels needed to be maximized in order to maintain the top and our bearish tactical expectations,” says David Sneddon, Head of Technical Analysis at Credit Suisse.

Sneddon adds: “We see support at 1.3690 initially, and below it should see a return to 1.3643/49, as this is seen as an incentive to retest 1.3571/67.” All in all, there is little major data expected from the UK during this week, leaving the dollar and international factors to be the factors influencing a busy period in the US calendar, the most prominent of which is the Federal Reserve's decision tomorrow Wednesday.

According to the technical analysis of the pair: On the chart of the daily time frame, there is a clear breakout of the downward trend of the GBP/USD currency pair. A complete exit from the channel requires stronger control for the bulls to move towards the 1.4000 psychological resistance. As mentioned before, the sterling will be subject to reports on the number of cases of infection with the Corona virus, with the country abandoning all restrictions.

The bears' control will return to the performance of the currency pair if it returns to the vicinity of the support levels 1.3750, 1.3680 and 1.3600, respectively. Amid the economic calendar devoid of important British data for the second day in a row. The currency pair will be affected today by the announcement of durable goods orders and then the announcement of the US consumer confidence index.