The GBP/USD currency pair showed some resilience, as the decline only reached the 1.3800 support level and settled around the 1.3840 level at the time of writing the analysis. Sterling remains optimistic that the British government will stick to July 19, British Freedom Day, from all restrictions of the COVID-19 pandemic.

The US dollar rose sharply against the rest of the major currencies after the release of US inflation figures that were much stronger than expected. US CPI inflation rose 5.4% y/y in June, well above the 4.9% the market had been expecting. The CPI rose 0.9% month-on-month in June, exceeding the 0.5% market expectation, while the core CPI rose 4.5% y/y, higher than expected 4.0%.

Investors sold US government bonds and stocks and bought dollars in anticipation of a more aggressive reaction from the Federal Reserve to higher prices. Commenting on the report, Fouad Razakzadeh, market analyst at ThinkMarkets.com says: "The latest inflation report in the US came in much higher than expectations, and the markets responded by sending the dollar up and the indicators down." "Obviously, the jump in the CPI was unexpected, given the market reaction," he adds.

The data suggests that inflation should be ahead of the pending expectations at the US Federal Reserve and that markets are betting on ending QE and that the first rate hike will inevitably be delivered. The US Federal Reserve has a mandate to ensure price stability near 2.0% and raising interest rates will act as a necessary hand brake to calm inflation.

The prospect of higher interest rates is attractive to international investors who seek higher returns, which in turn leads to an appreciation of the dollar. However, higher interest rates act as a brake on economic activity and the Fed is loath to raise interest rates before US unemployment rates drop to pre-pandemic levels. Commenting on the data, he predicted the reaction of the US central bank. “Another reading of sudden inflation is making it difficult for the Fed to stick to its position that higher inflation readings are merely fleeting,” says James Knightley, chief international economist at ING Bank.

Federal Reserve Chairman Jerome Powell will be asked to explain his views on inflation and the future of US interest rates when he appears before Congress this week. This certification constitutes the next significant event in the calendar for dollar exchange rates.

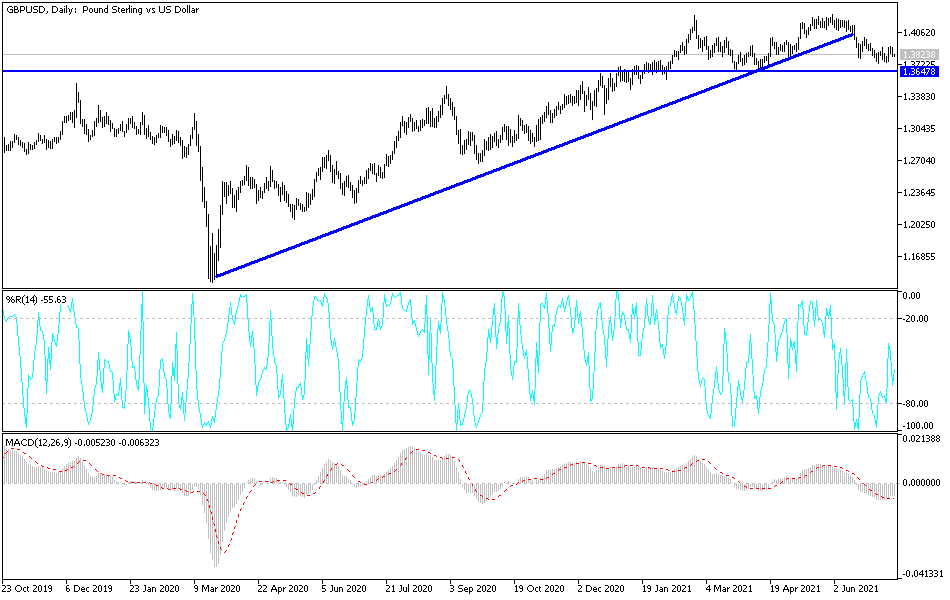

According to the technical analysis of the pair: The price of the GBP/USD currency pair stuck to stability around and above the 1.3800 level. This is giving the currency pair the last opportunity to avoid a stronger bearish slump. The sterling may remain in the position of steadfastness against the rest of the major currencies until the July 19th date and to abandon all Corona restrictions. In general, the closest support levels for the pair are currently 1.3790, 1.3700 and 1.3645. The second and third levels are capable of pushing the technical indicators to strong oversold levels, as shown on the chart of the daily time frame below. On the upside, the currency pair still needs to stabilize above the 1.4000 psychological resistance to have a strong correction opportunity. The sterling will be affected today by the announcement of British inflation figures, and the US dollar will be affected by the announcement of the producer price index reading and the reaction from the testimony of US Federal Reserve Governor Jerome Powell.