The market cautiously awaits what will result from a two-day meeting of the Federal Reserve. Today, the strongest focus will be on the tone of the bank's policy statement and the statements of Governor Jerome Powell. The markets want a specific date to tighten the bank's policy in light of the US economic recovery from the effects of the pandemic.

It appears that the British pound is ready to maintain its gains against the other major currencies, backed by improving sentiment regarding the situation of Covid-19 in the UK. The Bank of England is on track to raise interest rates in 2022. On the other hand, as the month ends, the importance of performance increases for investment asset managers as they rebalance their multi-trillion dollar portfolios to account for currency movements over the past month. For those who don't want to delve into the way the market works, what's important about the reform is that it's technically driven and not necessarily a fundamental step.

Therefore, the movement can often be reversed in a short time and those who are watching the market should be alert to fluctuations as the end of the month approaches.

Overall, the UK appears to be seeing a rapid decline in Covid cases which in turn supports the UK's economic growth outlook. Data released yesterday showed a massive 49.5% drop in Covid-19 cases week after week, making the sixth consecutive decline in daily cases and marking the now past the peak in the "third wave." Ian Shepherdson, chief economist at Pantheon Macroeconomics, says cases in England follow the Scottish track by about 18 days, suggesting further declines ahead.

The waning epidemic by economists is expected to boost business investment intentions as well as consumer confidence levels over the coming weeks. Both consumer sentiment and business investment intentions have suffered a setback in recent weeks as cases have increased, even as lockdown restrictions have eased.

Analysts at Goldman Sachs say the "next two weeks" remain challenging UK economic data, and as a result they are cautious about the Pound's near-term outlook against the rest of the currencies. “The data in the next two weeks will be important to gauge how the economy — and the health situation — is developing with fewer restrictions on activity,” says Zach Bundle, an analyst at Goldman Sachs.

Goldman Sachs says the BoE will likely maintain a slow and cautious approach to raising interest rates, a stance that will ultimately prevent any upward shifts in the value of sterling. The bank's thinking will come into sharp focus in August when the monthly policy meeting coincides with the release of the key quarterly economic forecasts.

It is in these meetings that any major policy shifts are noted.

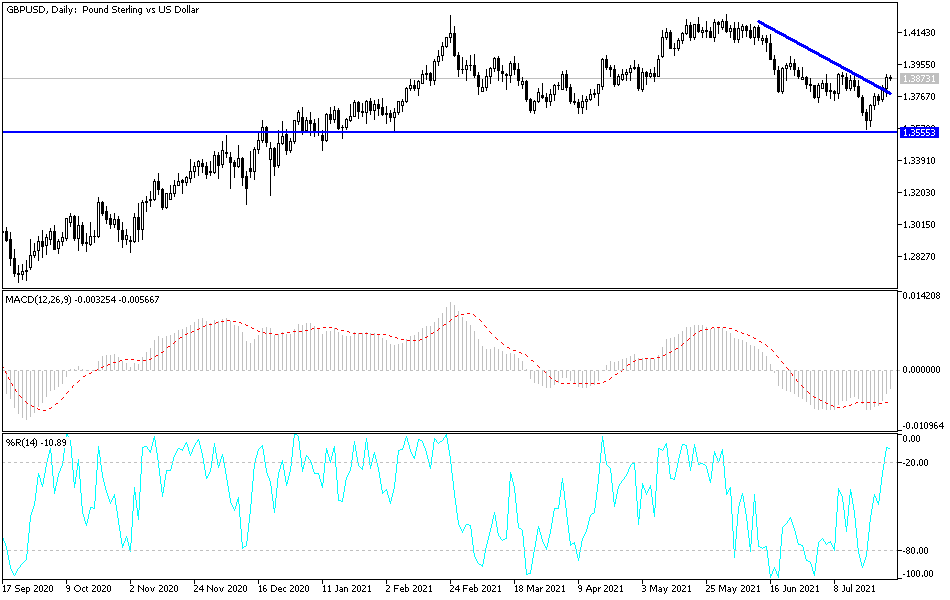

According to the technical analysis of the pair: There is a clear break of the recent bearish trend of the GBP/USD currency pair. The pair’s purchases may increase to move towards the 1.4000 psychological resistance level again in case it moves towards the 1.3920 resistance, which is the closest to it currently. On the other hand, returning to the support level 1.3760 will end the current bullish expectations and return the bears' stronger control again. The Fibonacci extension tool shows the levels that sellers may target. The 38.2% level is at 1.3656 and then the 50% level is at 1.3616. Stronger selling pressure could push GBP/USD to the 61.8% level which is in line with the swing low or the 76.4% level at 1.3526. The full extension is at 1.3446.

The 100 SMA is below the 200 SMA to confirm that the trend is still down and the resistance is more likely to hold than to break. The 100 SMA also held up recently as dynamic resistance on pullback.