The US jobs report with mixed results allowed the GBP/USD currency pair to recover for the third consecutive day, reached the level of 1.3898, which is stable around at the time of writing the analysis. The dollar has risen since last month due to the decline in bearish sentiments towards it, which resulted from the development of expectations for the policy of the Federal Reserve. Investors and traders are increasingly betting that the bank may raise the interest rate before the end of next year, before raising it again to 1% by the end of the year 2023.

"There are still a number of open questions about the Fed's balance sheet, including the timeline for the gradual announcement, the duration of the tapering process, and whether the committee will rule out a rate hike while the balance sheet is still in place," says Goldman Sachs analyst Zach Bandel

US interest rate prospects dominated market conversation even when Fed Governor Powell and others made clear in June that the Fed's policy priority was the government bond-buying program and its phased final liquidation, details of which may or may not be revealed on Wednesday. To the extent the meeting minutes reveal anything about the likely timing of the Fed's decision to reduce its footprint in the US government bond market, they will determine whether GBP/USD holds or sheds the 1.38 handle ahead of Friday's UK GDP report.

Sterling is tipped by analysts to remain supported amid expectations for the continued recovery of the British economy, buoyed by the removal of all Covid-related restrictions by July 19. British Prime Minister Boris Johnson confirmed on Monday at a press briefing held in 10 Downing Street that the final opening of the United Kingdom is likely to continue on July 19, subject to final approval on July 12. Johnson said the decision to go ahead with the full take-off of the economy as vaccines broke the link between infections, hospitalizations, and deaths.

"If we are not able to reopen society in the next few weeks ... we have to ask ourselves when we will be able to return to normal," Johnson said.

Lifting all restrictions removes any remaining restrictions on business and allows the economy to return to pre-Covid-19 levels sooner. Any subsequent benefits for business and consumer confidence are also expected to some extent to aid the economic recovery, which in turn is largely supportive of the Pound Sterling.

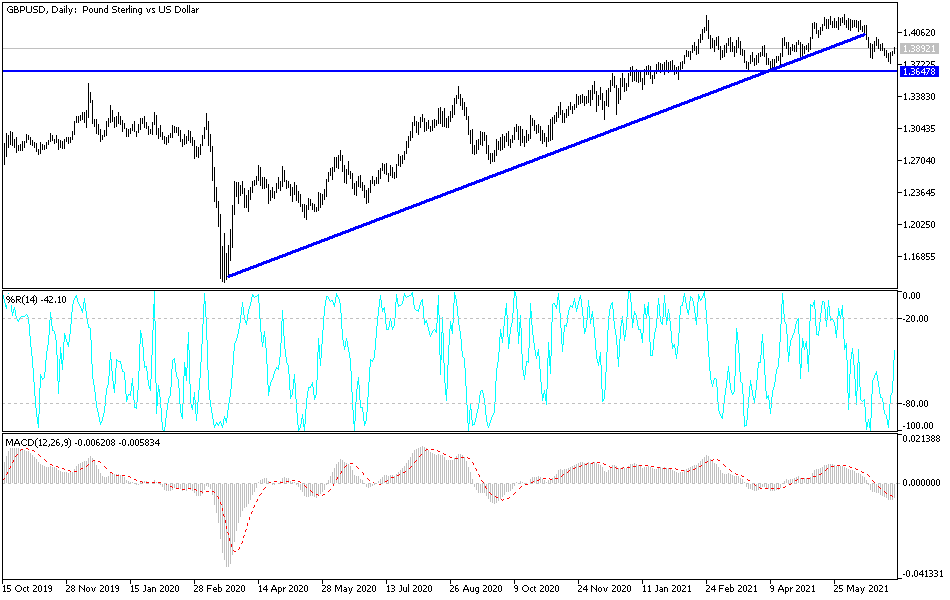

According to the technical analysis of the pair: The current move of the GBP/USD currency pair will not succeed without breaching the 1.4000 psychological resistance, which stimulates more market operations to buy the pair, thus rushing towards stronger ascending levels. On the daily time frame, the currency pair is still under downward pressure so far despite its recent attempts to rebound. The closest support levels for the pair are currently 1.3845, 1.3775 and 1.3690, respectively. The British pound will be affected today by the announcement of the construction PMI reading. The US dollar will be affected after returning from the holiday with the announcement of the ISM Services PMI reading.