It fell to the 1.3798 support level before settling around the 1.3820 level at the time of writing the analysis. The dollar is strong with expectations of raising interest rates and improving the results of economic data. The pound is facing pressure from the increase in Corona infections in the country, which may disrupt the government’s plans for the final outbreak. Data shows that UK households saved more money than economists expected in the first three months of 2021, suggesting the post-lockdown recovery could exceed current economic growth forecasts.

However, one economist says that the sudden rise in economic growth after the lockdown will eventually give way to sluggish economic growth as the UK's structural flaws start to surface again. The Office for National Statistics has released the final set of data covering the first three months of 2021 and revealing a larger-than-expected recovery in the household saving rate.

The data shows a 3.2% quarter-on-quarter decline in consumer spending, largely due to the January close. This is a revision from the previous decline of 2.6% on a quarterly basis reported by the Office for National Statistics. At the same time, there was a 0.1% quarter-on-quarter rise in reported household nominal income, giving the household savings rate a rise of 19.9%, up from 16.1% in the last quarter of 2020. Commenting on this, Paul Dills, Senior UK economists at Capital Economics: “This means that at around £190 billion (8.5% of 2019 GDP), the stock of excess savings that households accumulated during the lockdowns is slightly larger than we had anticipated.”

“This presents a greater upward risk to the pace and duration of the economic recovery in the future if households choose to spend it. As such, it adds to our view that the recovery will be slightly faster and more complete than most other forecasters expect.”

The Office for National Statistics reported that the UK's gross domestic product contracted by 1.6 in the first quarter compared to the previous quarter, while the year-on-year decline came at 6.1. An analysis from Pantheon Macroeconomics shows that the UK economy remains hardest hit in the G7 by Covid-19 in the first quarter of the year, with GDP falling 8.8% from its peak in the other quarter of 2019, even steeper than the 0.9% deficit. in the United States. 4.7% in France and 5.0% in Germany.

Macroeconomics Pantheon expects UK GDP to rise 5.3% in the second quarter, and they expect it to rise another 2.0% in the third quarter, before just exceeding its previous peak in the first quarter of 2022. But as for the outlook in the longer term, the Pantheon outlook for the British economy makes for a poor reading.

Analysts are of the view that under current plans, the UK government is expected to tighten fiscal policy significantly in 2022, with renewed cuts to departmental expenditures and a freeze on income tax limits. Meanwhile, exports are likely to remain restricted due to new trade barriers imposed at the beginning of this year. Besides, slow growth in the labor force, which reflects the aging of the local population, lower levels of immigration compared to the first decade of the twenty-first century, and the absence of government policies to promote participation, will also hamper UK growth.

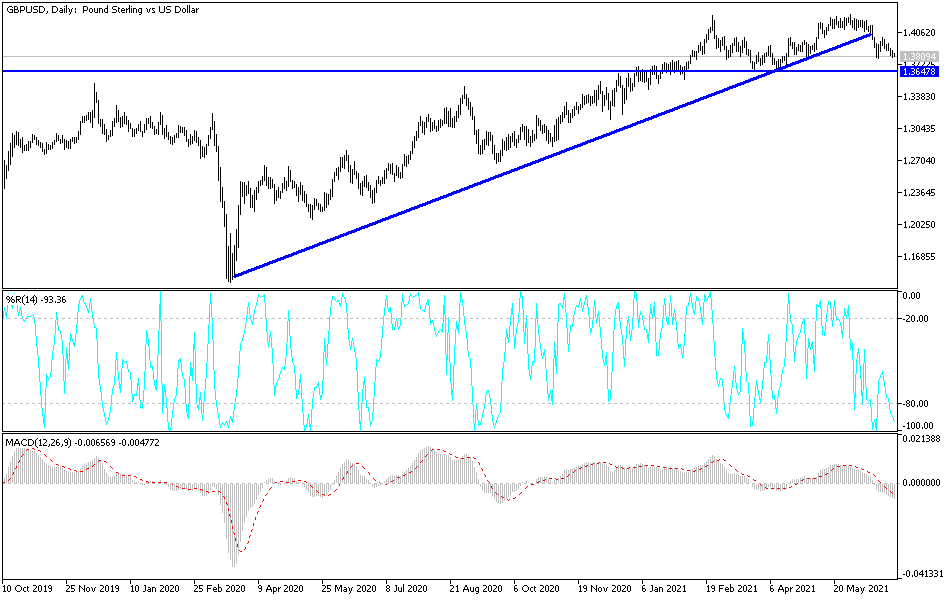

According to the technical analysis of the pair: On the daily time frame, there will be no opportunity for the bulls to move the GBP/USD in the upward direction without moving towards the 1.4075 resistance. The technical levels reached oversold levels without moving towards the support levels 1.3765 and 1.3680, respectively. The pair is in a clear breaking stage of the general trend.

As for the economic calendar data: From Britain, the manufacturing PMI reading will be announced. The US dollar will be affected by the announcement of the weekly jobless claims and the ISM manufacturing PMI reading.