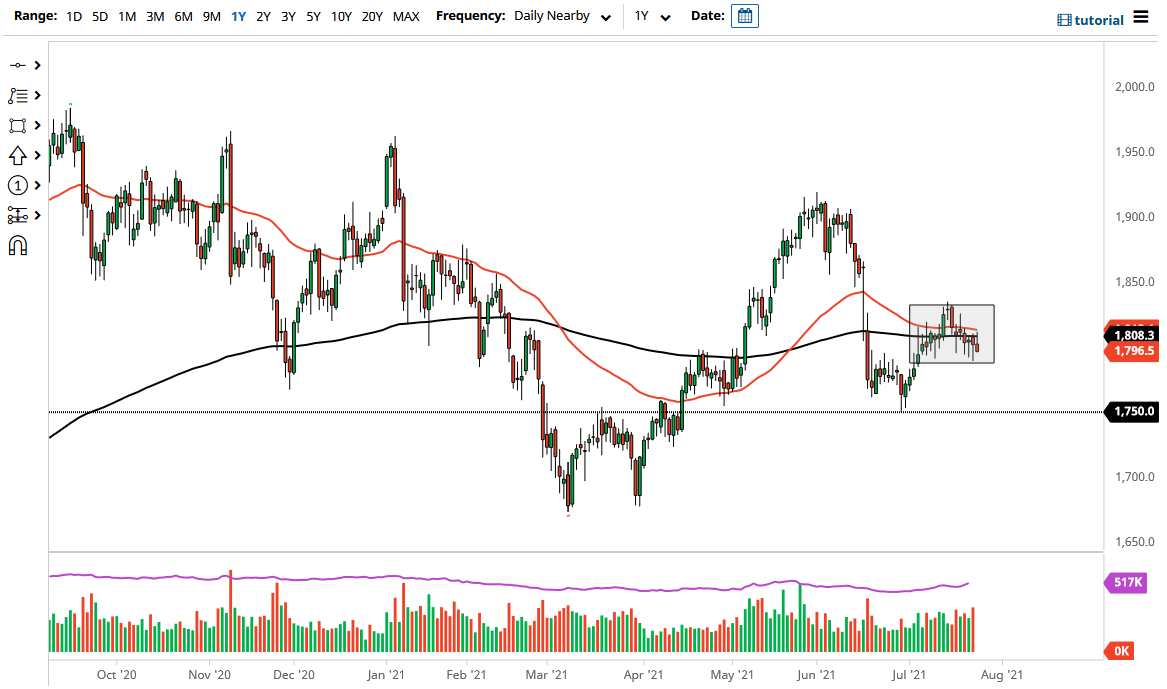

The gold markets initially tried to rally during the trading session on Monday but struggled above the 200-day EMA as we continue to see resistance above. Looking at the chart, you can see that we have been in a range for a while, with the $1790 level underneath having been supportive more than once, as we had formed several hammers previously. But at this point, it looks as if the market is going to test that area yet again. If we break down below the $1790 level, it could give us a bit of a “heads up” as to what is going to happen next.

If we break down below that $1790 level, it is likely that we go looking towards the $1750 level underneath, which is where we had seen a massive bounce previously. That is an important thing to pay attention to, because if we break down below that level it is likely that we will go looking towards the double bottom at the $1680 level. That is an area that has shown itself to be important more than once, and I think will be a place that a lot of people pay close attention to. This was the beginning of the major move that we had seen higher, and as a result, if we were to break down below there, it is likely that the market could go looking towards the $1500 level.

To the upside, if we were to break above the 50-day EMA, then it is likely the market would go looking towards the $1830 level. If we can break above there, then it is likely that we will go looking towards the $1860 level after that. In general, this is a market that is going to move counter to the US dollar and, as a result, you have to pay close attention to the US Dollar Index. With that being the case, I think you need to be cautious about your position sizing as the volatility will continue to be very difficult to come to terms with. Ultimately, this is a market that continues to be manipulated by the risk appetite and currency flows as the market continues to see a consolidation area as you can see on the chart, but it certainly looks as if it is going to be broken.