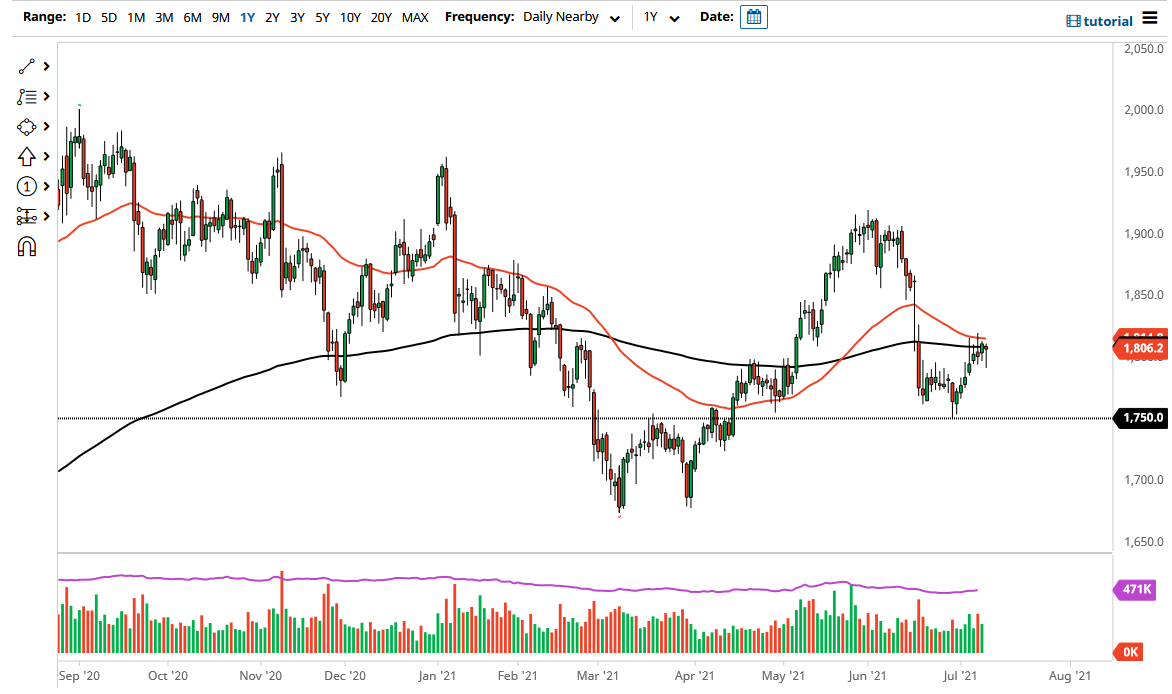

The gold markets were all over the place during the trading session on Monday, initially falling rather hard, but then turned around to form a bit of a hammer by the end of the day. We ultimately closed basically unchanged, sitting right at the 200-day EMA yet again. The 200-day EMA is an area that a lot of people will pay close attention to, and it is obvious that it has been acting essentially as a bit of a magnet for price. That being said, I think at this juncture we are still trying to figure out where to go next.

At this point, if we can break above the highs of last week, then I believe that the market will probably go looking to fill the gap above. The $1860 level would be a target based upon that gap, so filling the gap makes the most amount of sense in the short term. Whether or not we can break out above there is a completely different question, but if we do break above there then it would be an extraordinarily bullish sign. Gaps do typically get filled in the futures market, but they also typically offer significant support or resistance. At this point, the market looks very likely to make a bigger decision. If we do break to the upside, it could be the beginning of something rather long term, perhaps opening up the possibility of reaching towards the $2100 level.

To the downside, the market still continues to see a lot of support at the $1750 level, and that is going to be the target if we break down below the lows of the trading session on Monday. Regardless, I think this is going to be a very noisy and choppy market, and it will have a major influence from external pressures such as what the US dollar is doing. The 10-year yield also will have a lot to say as well, so this is a market that continues to see a lot of erratic behavior, so I would be cautious about my position size. With this being the case, the market is likely to see a lot of caution, so I think this is a situation where you will need to be very cautious and simply add as the move works itself out.