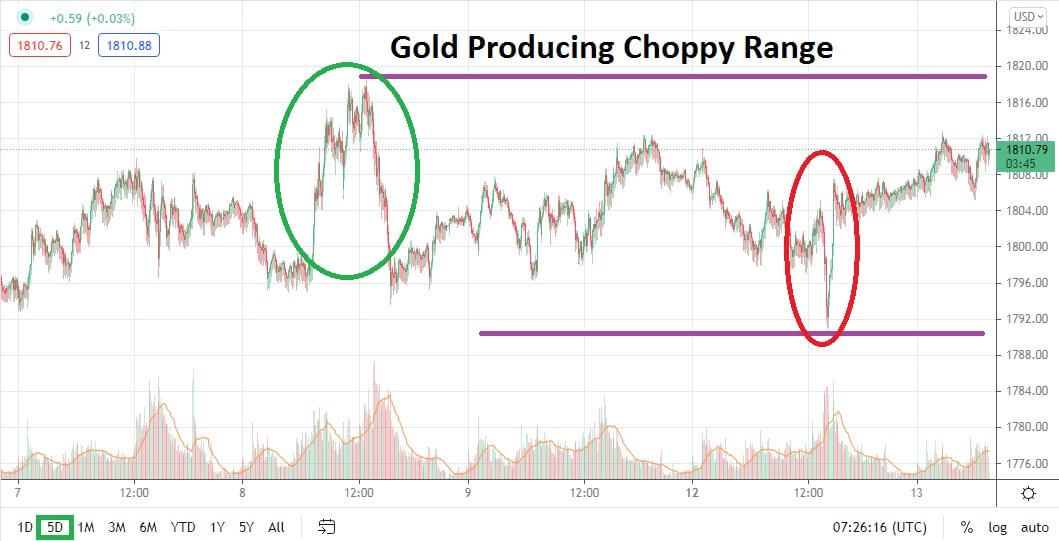

Gold is trading near the 1810.00 level in early trading today as speculators ponder the next wave of price impetus from the precious metal. After achieving a high of around 1818.00 on the 8th of July, gold slumped below 1790.00 in early trading yesterday. A reversal higher then took place, which now sees the precious metal perched near its current price, but conditions have been choppy in the short term.

Gold has done particularly well in July after testing lows in late June near the 1750.00 juncture. Clearly, a large amount of buying stepped into gold at those prices with the beliefd that technical lows looked durable and the notion the metal was undervalued. Gold experienced volatile trading in June because of sentiment generated by the U.S Federal Reserve. Before the FOMC announcement from the US on the 16th of June, gold was trading near a high of around 1860.00.

But before bullish speculators try to chase those higher prices as a target, they should contemplate current resistance levels and look at a three-month chart. If a short-term trader looks at a three-month chart they will notice that gold is actually trading near values it traversed in mid-May. Yes, a climb upwards happened from mid-May until the 1st of June, which saw gold climb above the 1900.00 level. However, this doesn’t mean the precious metal is about to retrace these highs in the short term.

The 1800.00 level certainly looks like interesting short-term support and it is a definite psychological barrier that should be contemplated. If gold can continue to trade above this level and sustain signs of upward momentum by remaining above the 1810.00 juncture this can be interpreted positively. However, conservative bullish speculators may want to see the highs from the 8th of July surpassed before they jump onto the bandwagon and pursue upwards mobility.

Gold is within an intriguing testing ground and its current price could prove attractive for short-term traders who have consistent and cautious take-profit ambitions. Stop-loss choices will be important to use to guard against sudden volatility. Traders who want to pursue buying positions of gold on slight pullbacks lower which come within the 1808.00 to 1802.00 junctures may be proven correct if they are looking for quick reversals higher.

Gold Short-Term Outlook:

Current Resistance: 1818.00

Current Support: 1798.00

High Target: 1830.00

Low Target: 1791.00