The decline in long-term Treasury yields shows concerns about growth due to the spread of the variable delta spread of the Corona virus and has led to a high demand for the precious metal as a safe haven. Meanwhile, investors have been largely taking cautious steps as they await the outcome of the US central bank's two-day monetary policy meeting, which begins on Tuesday. The central bank will announce its monetary policy on Wednesday. The Fed is expected to leave interest rates unchanged, but investors will heed any comments regarding the bank's asset purchase program.

On the other hand, the US dollar index DXY fell to 92.53 before recovering slightly to 92.62, which is still significantly lower than its previous close at 92.91. In the metals market, silver futures contracts closed at $25,318 an ounce, while copper futures contracts for September settled at $4.5850 a pound.

A survey showed that German business confidence fell unexpectedly in July, as managers' optimism clouded by supply problems of raw materials and other products and by a rise in coronavirus cases. On another sentimental level, tensions between the United States and China escalated after Chinese Vice Foreign Minister Xie Feng said that the relationship between the world's two largest economies "is now at a standstill and faces serious difficulties."

In US economic news, a report from the US Commerce Department showed an unexpectedly sharp drop in new home sales in June. The report said new home sales fell 6.6% to an annual rate of 676,000 in June after declining 7.8% to a revised rate of 724,000 in May. Economists expected new home sales to jump 4% to an annual rate of 800,000 from 769,000 originally reported for the previous month.

With the unexpected decline, US new home sales fell to their lowest annual rate since reaching 582,000 in April of last year.

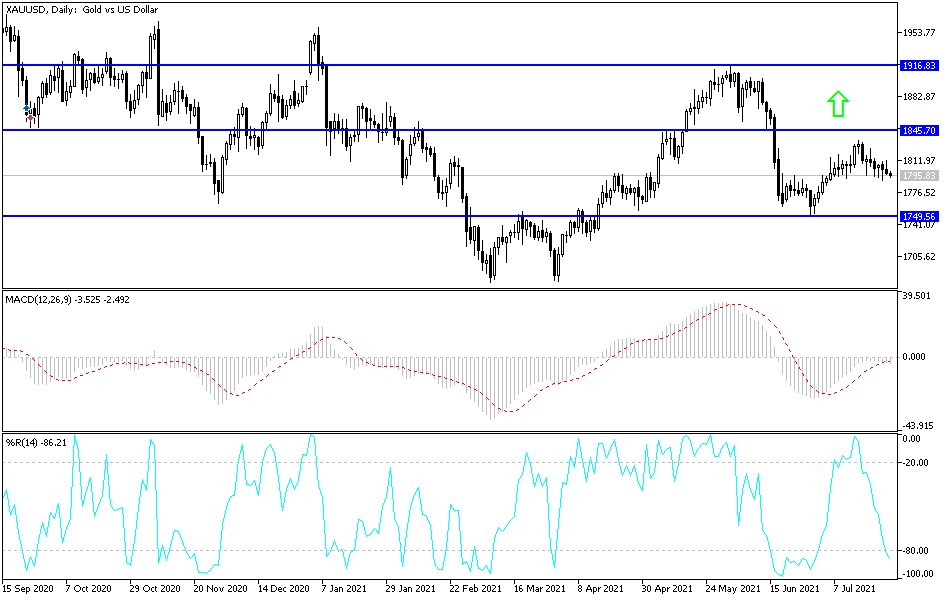

According to the technical analysis of gold: The failure of the last rebound contributed to the emergence of the formation of the head and shoulders. This reinforces the selling technically for the correction, and the price of gold is currently the closest to testing the support levels 1789, 1775 and 1760, respectively. I still prefer buying gold from every bearish level. The widespread Corona Delta variable continues to dominate the effects on the markets and investor sentiment. This will be a good environment for investors to buy safe havens on an ongoing basis.

On the other hand, the most important targets for bulls to control performance are the resistance levels 1816, 1827 and 1845, respectively.