In addition to the dollar level, gold remained in good condition to move higher amid concern about the regulatory decisions of China, which shook the global stock markets. In addition to fears of increasing global infections with the Corona Delta variable, it forced some global economies to impose restrictions again. The US-Chinese skirmishes over trade and the origin of the Corona pandemic are forcing investors to buy gold as a safe haven.

The FOMC, which concluded its two-day monetary policy meeting, left the target range for the federal funds rate unchanged between 0 and 0.25 percent, and said it would continue its $120 billion monthly bond purchase program. The US central bank's move is in line with expectations. The bank, which said that the US economy is strengthening despite fears of the spread of the Corona virus, stressed that progress in vaccinations is likely to continue to limit the effects of the public health crisis on the economy. However, he added that risks to the economic outlook remain.

The central bank statement after the meeting indicated that “the sectors most affected by the epidemic showed improvement, but did not fully recover.” And “inflation rose, which largely reflects transitional factors. Public financial conditions remain favorable, in part reflecting policy measures to support the economy and the flow of credit to US households and businesses.”

Indicating that progress has been made towards the central bank's goals related to employment and inflation, the bank's statement said that changes in policy regarding monthly bond purchases may be on the way. The Fed said the FOMC will continue to assess progress at upcoming meetings.

On the other hand, it affects the market. The US State Department said Secretary of State Anthony Blinken met with the head of the World Health Organization to press for additional studies on the origin of the coronavirus pandemic in China. State Department spokesman Ned Price said Blinken told Tedros that any follow-up investigation into the COVID-19 outbreak must be "timely, evidence-based, transparent, expert-led, and free of interference."

In a statement, Price said Blinken also stressed the importance of international unity in order to understand the pandemic and prevent future pandemics. He added that Blinken and Tedros have a commitment to work with all WHO members "to make tangible progress in strengthening global health security to prevent, detect and respond to epidemics and health threats in the future."

The meeting, which was not previously announced, came after China rejected calls by the World Health Organization for a second investigation into the virus.

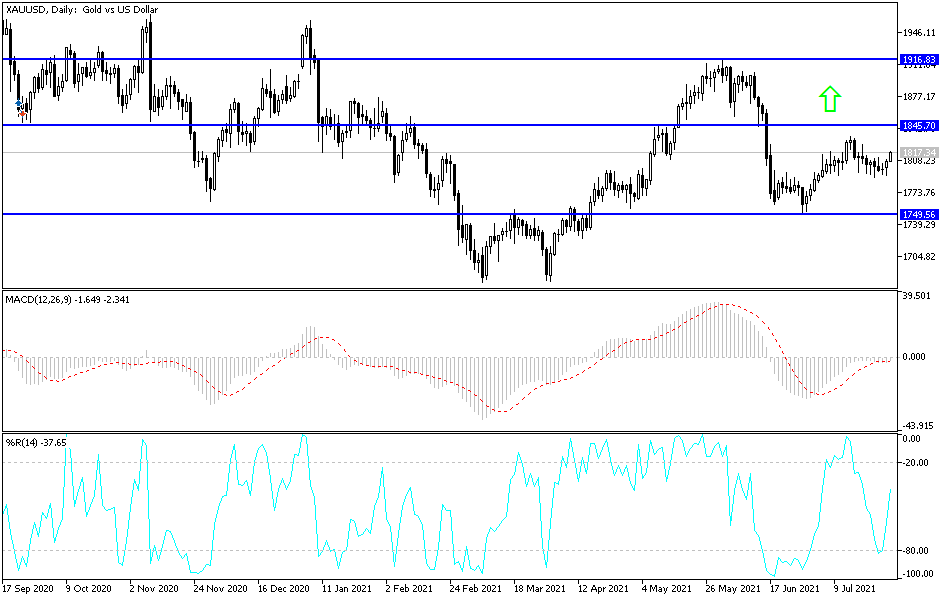

According to the technical analysis of gold: The stability of the gold price around and above the psychological resistance of 1800 dollars an ounce will continue to motivate the bulls to move higher because it stimulates more purchases of gold. Looking at previous technical analyses, you will find that gold is moving towards the resistance levels now identified around the first level, and more bulls' control will push gold to the next levels of 1827 and 1845 dollars, respectively. On the other hand, the return of the bears' control over performance depends on the return of the gold price to the support area of 1775 dollars per ounce. I still prefer buying gold from every bearish level as long as the factors mentioned at the beginning of the analysis exist.

The price of gold will be affected today by the extent to which investors take risks or not, as well as the reaction of the US dollar to the announcement of the growth rate of the US economy and the number of weekly jobless claims.