In the middle of this week's trading, the price of an ounce of gold fell to the $1,751 support level, its lowest in nearly three months. Gold then settled around $1,779 an ounce at the time of writing the analysis. The strength of the US dollar still negatively affects the path of gold, but there are other factors that support it. Some include the renewed global fears of the variables of the Corona virus, and the resorting of some countries to some restrictions. This threatens global efforts to contain the pandemic. Despite continued optimism about a strong US economic recovery, market sentiment has been somewhat cautious due to the surge in delta-type coronavirus in many Asian and European countries and lockdown measures in many places around the world.

Gold futures fell more than 7% in June. In the first half of 2021, gold futures fell 6.6%. In contrast, silver futures closed at $26.194 an ounce, while copper futures settled at $4.2890 a pound. In general, the gold price suffered its worst monthly loss in nearly five years, as bulls were subjected to the value of the yellow metal to be shocked by the ongoing speculation about reducing stimulus and raising interest rates by the US central bank.

Data from data processing company ADP showed that private businesses in the United States employed 692 thousand workers in June, higher than expected when adding 600 thousand. However, employment in June was well below the 886,000 downwardly revised jobs in May. On the other hand, according to a report issued by the Institute of Supply Management (ISM), the MNI Chicago Business Barometer came in with a reading of 66.1 for the month of June, down from a reading of 75.2 in the previous month.

Data from the National Association of Realtors (NAR) showed US pending home sales rose 13.1% year on year in May, after rising 51.7% in April. Investors are now awaiting the important June Nonfarm Payrolls data, due for release on Friday (July 2).

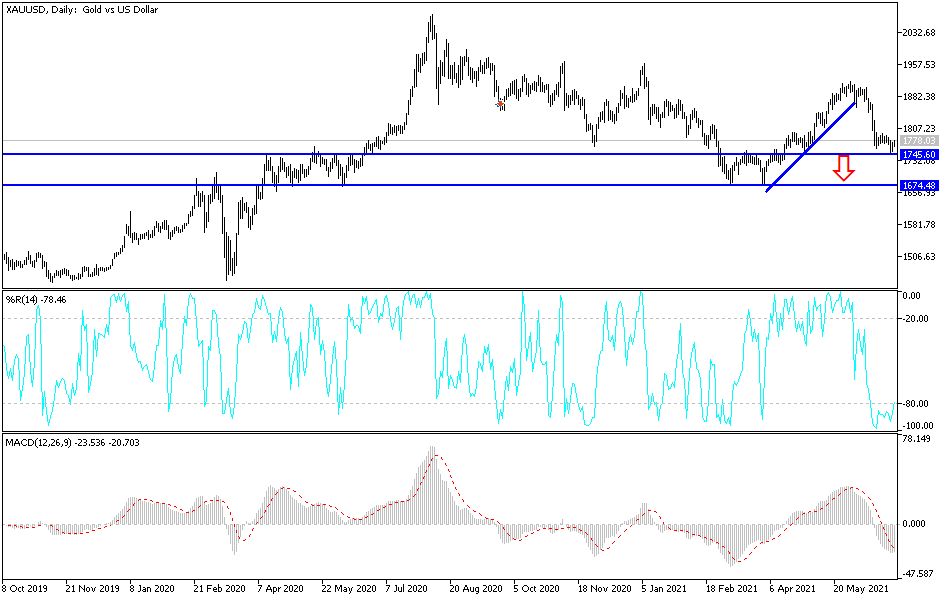

According to gold technical analysis: The continuation of the strength of the US dollar and the continuation of the weakness of the gold price, pushed the technical indicators to strong oversold levels. It may find the opportunity to rebound upwards quickly if the dollar’s gains stopped due to the negative results of the upcoming important economic data, especially the US jobs report tomorrow.

I prefer to buy gold from every bearish level and the closest support levels are currently 1752, 1740 and 1725 dollars, respectively. On the other hand, there will be no opportunity for the bulls to launch higher without breaching the psychological resistance level of 1800 dollars an ounce.

Gold will be affected today by the level of the US dollar and the extent of investors' appetite for risk or not. It will also be affected by the announcement of the industrial purchasing managers' index reading for major economies, as well as the announcement of the number of US weekly jobless claims.