The US dollar’s gains and fears of the rapid spread of the Corona Delta variable have ended. These factors contributed to the stability of the gold price. It is above the psychological resistance of 1800 dollars an ounce throughout last week’s trading, with gains to the resistance level of 1819 dollars an ounce. This is its highest in nearly a month before closing trading for the past week around the 1808 level per ounce. Despite the great recovery in global financial markets, the yellow metal found additional support with lower US Treasury yields. The gold price recorded a weekly gain of about 2%, reducing its loss since the start of 2021 to date to less than 5%.

As for silver, the sister commodity to gold, it ended the trading week above the $26 level. As silver futures rose to $26.25 an ounce. The white metal recorded a weekly gain of 0.4%, although silver prices are still down about 1% over the year 2021.

Despite the impressive comeback among economic indicators, investors remain ostensibly concerned about the impact a delta variable could have on an economic recovery — both at home and abroad. This made market analysts bet that gold could reach $1,850. Bart Melek, Head of Commodity Strategies at TD Securities said, “We continue to have issues with the delta variable. This could significantly slow down economic progress, not only in the United States, but of course around the world."

"Since investors are convinced that the US Federal Reserve is already targeting full employment and is in fact not particularly concerned about inflation moving above targets for a certain period, we can see the price of gold moving above $1,850 by the end of the year," he added.

In the United States, the number of cases of the new coronavirus has risen to 23,000. The death toll exceeded 600,000 people. Meanwhile, bond yields rebounded from last week's massive declines, with 10-year Treasuries rising to 1.36%. The value of the one-year note rose to 0.068%, while the 30-year note rose to 1.987%. However, the treasury market was drowning in a sea of red ink last week, which is good for gold as it reduces the opportunity cost of holding non-yielding bullion.

The US Dollar Index (DXY), which measures the greenback against a basket of six major rival currencies, fell to 92.12, from Friday's opening of 92.36. Accordingly, the index recorded a weekly decrease of 0.1%. A weak dollar is also good for dollar-denominated commodities as it makes them cheaper to buy for foreign investors. As for the prices of other metals, copper futures rose to $4.3435 a pound. Platinum futures rose to $1098.30 an ounce. Palladium futures rose to $2815.00 an ounce.

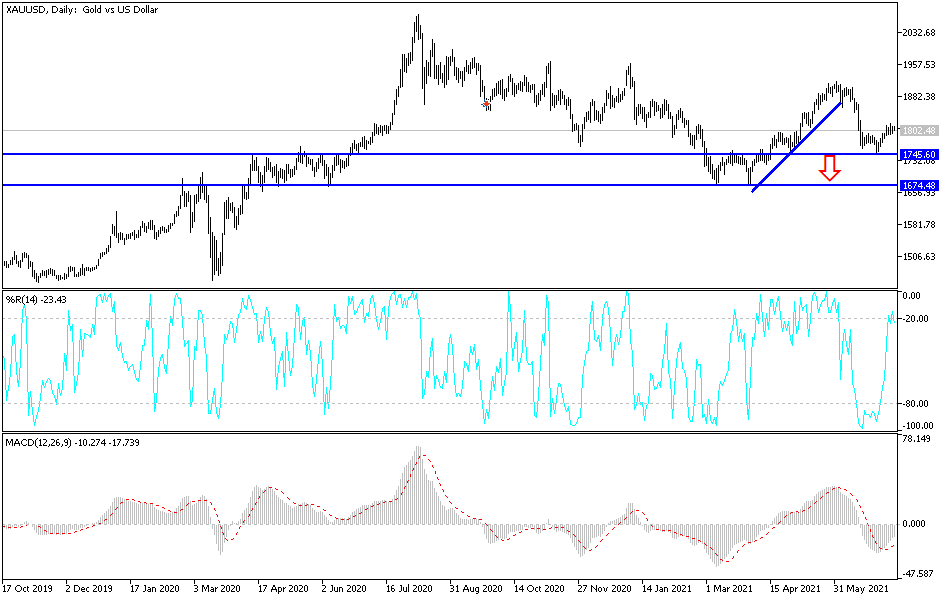

According to the technical analysis of gold: The stability of the gold price is above the psychological resistance of 1800 dollars an ounce and it will remain technically supportive of the bullish trend again. In order to confirm the control of the bulls, the gold price needs to move towards the resistance levels of 1822, 1835 and 1855 dollars. In the current environment, I still prefer buying gold from every bearish level, as the delta variable is more widespread and deadly. The exposure of global economies to what India has been exposed to will be a strong threat to the future of the expected economic recovery for the remainder of the year 2021.

The closest support levels for gold are currently 1792, 1785 and 1763 dollars.