During yesterday's trading, the price of an ounce of gold recovered to the resistance level of $1825 after selling at the beginning of the week's trading. It then reached the support level of $1795 an ounce and settled around the level of $1810 an ounce at the time of writing the analysis. Gold returned to rise with motivating factors, led by the return of global fears of the rapid spread of Corona’s variables, which threaten the future of global economic recovery and prolong the recession, and therefore global central banks abandoned the recent policy tightening signals.

The strength of the US dollar negatively affects any gains in the price of gold.

The US dollar recovered against the other major currencies, hitting a three-month high, amid concerns that the rise in the coronavirus variable could affect the global economic recovery. On the economic side, a report issued by the Commerce Department showed that new residential construction in the United States showed a significant increase in June. The official report said that housing starts rose 6.3% to an annual rate of 1.643 million in June after jumping 2.1% to an average of 1.546 million in May. Economists had expected home construction to increase 1.1% to a rate of 1.590 million from 1.572 million originally reported for the previous month.

The Centers for Disease Control and Prevention has put the UK in the highest risk category, ordering US citizens to "avoid travel to the UK". Brazil, South Africa, and the Netherlands are also included in the Tier 4 category due to a sharp rise in infections.

Global stock markets fell back as investors feared the re-emergence of coronavirus infections. The delta variant is driving the most cases in the United States and around the world, with experts blaming unvaccinated people. This leads to concerns that the growing number of infections could hamper the economic recovery.

Another major concern for investors is inflation. The annual inflation rate in the United States of America exceeded 5% last month, while producer prices exceeded 7%. With expectations of consumer inflation continuing to rise, some market analysts believe shoppers may stay home in the coming months.

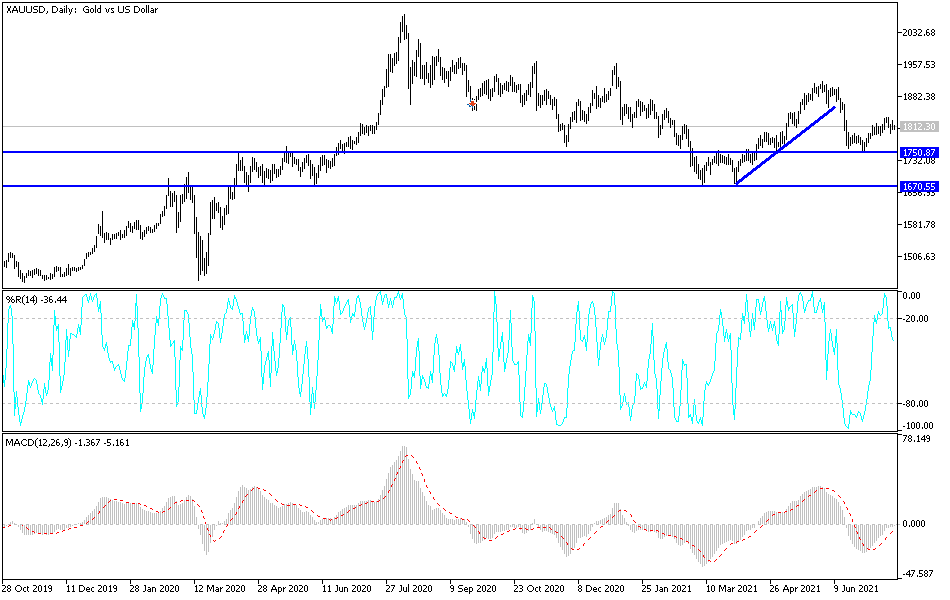

According to the technical analysis of gold: I still see that the stability of the gold price above the psychological resistance of 1800 dollars an ounce supports the upward trend and the willingness to move towards stronger upward levels, the closest to them currently are 1819, 1832 and 1845 dollars. This will be possible with the support of stopping the gains of the US dollar and increasing investor demand. Buying safe havens and yellow metal is one of the most important. Amid global anxiety, I still prefer buying gold from every bearish level.

The closest support levels for gold are currently 1793, 1785 and 1770.