It succeeded for a short time in testing the resistance level of $1825 an ounce, and by the end of the week, amid profit-taking sales, it retreated to the price of $1790 an ounce, before closing trading stable around the resistance of $1802 an ounce. With this performance, the price of the yellow metal recorded its first weekly loss in five weeks. This is in addition to its decline since the beginning of the year 2021 to date by more than 5% and with the rise of the US dollar and the rise of stock markets.

As for the price of silver, the sister commodity to gold, it is also trying to avoid a dip below $25. Silver futures fell to $25.25 an ounce. Accordingly, the white metal recorded a weekly loss of about 1.8%. Since the beginning of the year 2021 until now, silver prices have decreased by about 5%.

While gold appears to be in a bear market, market analysts believe that any move below the $1800 threshold could be a buying opportunity. In this regard, Christopher Looney, an analyst at RBC Capital Markets, said in a research note: “Volatile elsewhere is generating volatility for gold, but we continue to believe that there is an unappreciated downside risk to current prices, as our forecasts currently indicate.” "Economic data, Fed policy expectations and news about the prevailing strains of COVID will continue to dominate gold directly and indirectly (through moves in the dollar, interest rates and stocks)," he added.

However, gold is mostly falling on the back of a stronger dollar and higher bond yields.

The US Dollar Index (DXY), which measures the performance of the US currency against a basket of six major competing currencies, rose to 92.93, and accordingly the index recorded a weekly gain of 0.3%, which contributes to its rise since the beginning of the year 2021 to date by 3.4%. In general, a stronger dollar gain is bad for commodities priced in it because it makes them more expensive to buy for foreign investors. On the other hand, affecting the gold market, the benchmark 10-year bond yield rose to 1.29%. One-year bond yields fell to 0.068%, but 30-year yields jumped to 1.935%. Higher Treasury yields are downside for gold as the opportunity cost of holding non-yielding bullion is higher.

In other metals markets, copper futures jumped to $4.3665 a pound. Platinum futures fell to $1,054.00 an ounce. Palladium futures fell to $2665.00 an ounce.

The chaos and confusion over travel rules and procedures to contain the outbreak of new viruses is contributing to another harsh summer for the turbulent European tourism industry. The travel and tourism industry in Europe is in dire need of compensation after the disaster of 2020. Last year, the number of international tourist arrivals to Europe fell by nearly 70%, and during the first five months of this year 2021 their number fell by 85%, according to the United Nations World Organization. Tourism organization figures.

In the latest development, it may worry investor sentiment. The United States of America this week raised its travel warning for Britain to the highest level. The Centers for Disease Control and Prevention advised Americans to avoid travel to the country due to the risk of contracting COVID-19 variants, while the US State Department raised the alert level to "do not travel" from the previous, lower-risk "travel review".

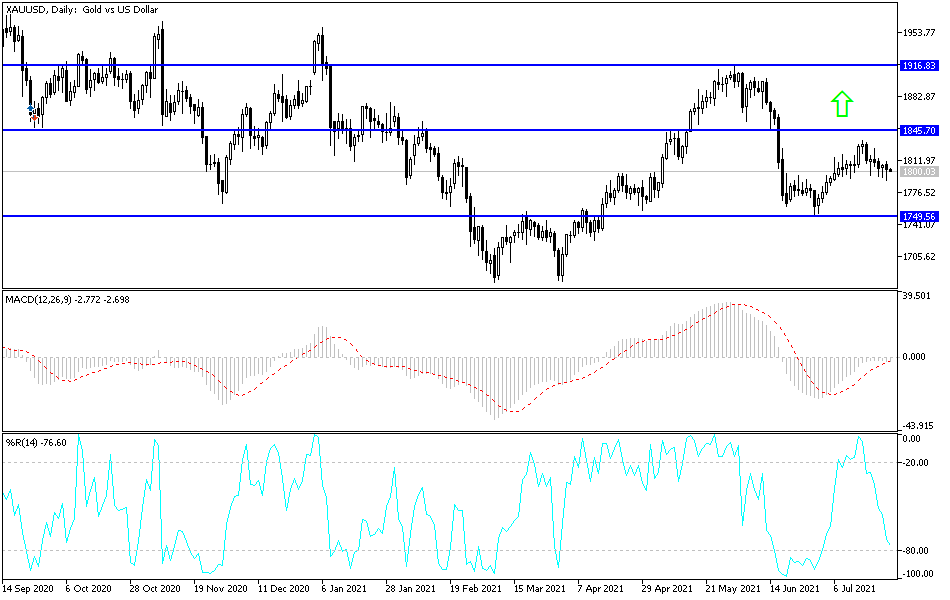

According to gold technical analysis: There is a clear break of the last bullish channel for gold, and the bears’ control will be strengthened if prices move below the $1800 level, the most important for bulls. And that gold will move towards the support levels 1792, 1780 and 1765, respectively, and from the second and third levels, it is best to make gold purchases. Currently the closest targets for the bulls are 1819, 1827 and 1845 dollars, respectively. The MACD indicator is still in the upside starting position. I still prefer buying gold from every bearish level.

The gold price will be affected today by the level of the US dollar and the extent to which investors are willing to risk or not, as well as the reaction to reports of the number of cases of infection with the Corona Delta variable in global economies that went to abandon Corona restrictions.