The yellow metal joins the sell-off that dominated the markets last Friday, supported by a stronger US dollar, higher Treasury yields, and weak monetary policy. Market analysts are optimistic that gold prices are still above $1800. The price of an ounce of gold fell at the end of trading to the level of 1809 dollars, after last week's gains, to the resistance level of 1834 dollars an ounce, its highest in a month.

Gold posted a tepid weekly gain of 0.3%, but the yellow metal is still down around 5% YTD 2021.

In the same performance, silver, the sister commodity to gold, fell to less than $26 by the end of the week's trading. Silver futures collapsed 2.46%, to $25,745 an ounce. Accordingly, the white metal recorded a weekly decrease of close to 2%, adding to its decline throughout 2021 by 3%.

All in all, financial watchers note that the bulls are still likely to lead the bullion market for the time being. Although monetary policy has taken a softer approach, it is unlikely that major global central banks will ease overly aggressive stimulus and relief efforts.

Speaking before the House Financial Services Committee last week, Fed Chair Jerome Powell indicated that reducing some of the institution's stimulus would prevent the US economy and labor market from recovering from the pandemic economy. He also assured policy makers that hot inflation would be short-lived, so it would not be necessary to scale back unprecedented quantitative easing tools.

Powell's comments came at the same time that US Treasury Secretary Janet Yellen warned that "rapid inflation" would remain here for several more months, although inflation concerns were ruled out earlier this year.

Meanwhile, all eyes are on the growing number of coronavirus cases in the United States. Investors are concerned that new variants of the pandemic led by Delta and Lambda may force more governments nationwide to reimpose public health restrictions, potentially limiting economic growth. The seven-day average has risen to its highest level in three months at more than 35,000. The daily death toll is still three figures, bringing the grand total to more than 608,000 dead in the USA alone.

For the US bond market, Treasury yields were mostly higher, with 10-year yields rising 0.015% to 1.312%. One-year bond yields rose 0.002% to 0.076%, while 30-year yields jumped 0.019% to 1.938%. A bullish bond market is usually bearish for non-yielding bullion because it raises the opportunity cost of owning the metal. On the other hand, affecting the performance of gold. The US Dollar Index (DXY), which measures the performance of the US currency against a basket of six major rival currencies, rose to 92.68. The US dollar index DXY succeeded in achieving a weekly gain of 0.6%, in addition to an annual increase of 3.06%. In general, a stronger US dollar profit is bad for dollar-priced commodities because it makes them more expensive to buy for foreign investors.

In other metals markets, copper futures fell to $4,316 a pound. Platinum futures fell to $1,105.70 an ounce. Palladium futures fell to $2,628.50 an ounce.

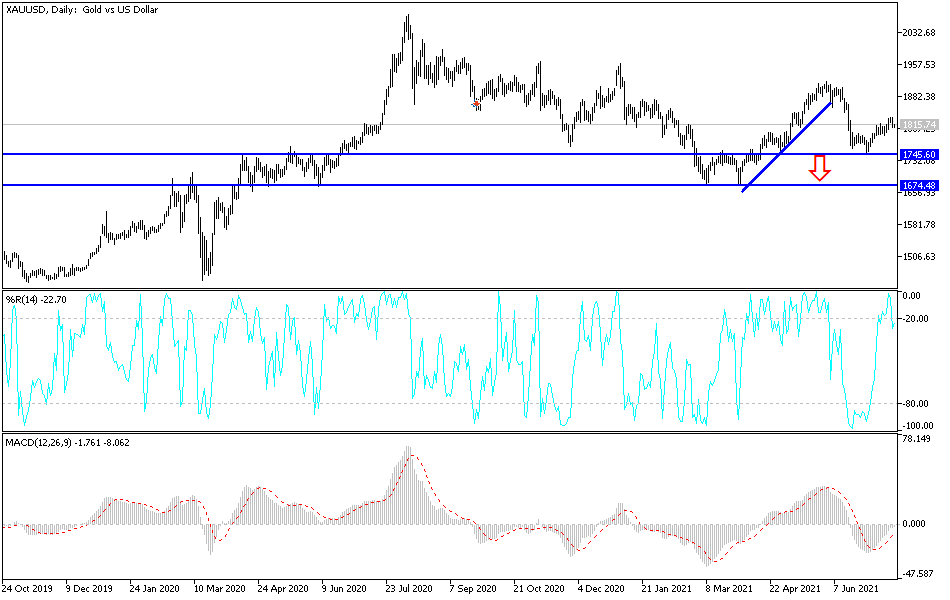

According to gold technical analysis: Despite the decline at the end of last week’s trading, the price of gold has a last chance to maintain the last bullish channel as long as it is stable above the psychological resistance of 1800 dollars an ounce that supports the bulls’ dominance. As I mentioned before, the return of fears of increasing infections and deaths in the epidemic around the world, the return of containment restrictions, and the abandonment of global central banks, especially the US Federal Reserve, from a tone near to tightening monetary policy, will motivate investors again to buy gold.

Therefore, we still recommend buying gold from every descending level, and the closest support levels for gold are currently 1805, 1785 and 1770, respectively. On the other hand, the success of the bulls to push the price of gold above the resistance of $ 1835 an ounce, which it recently moved to, will increase the control of the bulls and thus launch to stronger upward levels, with which it begins to think about the next psychological resistance of 1900 dollars an ounce.