The decline of the US dollar stopped the losses in the price of an ounce of gold, which reached the support level of 1793 dollars. The price of gold is now stable around the level of 1807 dollars an ounce at the time of writing the analysis. The dollar weakened ahead of the US Federal Reserve's monetary policy announcement on Wednesday. Weakness in stock markets in the wake of China's regulatory crackdown on US-listed technology companies also contributed to the rise in precious metal prices. Silver futures closed at $24.64 an ounce, while copper futures settled at $4.5445 a pound.

The US Federal Reserve's two-day policy meeting has begun. Today, investors are waiting to see how the US central bank will balance rapidly rising prices with the complexity of increasing infections with the Corona virus. The Fed's policy statement will be released at 2 PM ET on Wednesday, followed by a press conference by Fed Chair Jerome Powell.

On the economic news front, the US Commerce Department released a report showing durable goods orders rose 0.8% in June after rising by an upwardly revised 3.2% in May. Economists had expected orders to rise 2.1% compared to the 2.3% jump reported the previous month. Excluding transportation equipment orders, durable goods orders rose 0.3% in June after a 0.5% increase in May. Previous transfer orders were expected to rise 0.8%.

A separate report from the Conference Board showed that US consumer confidence improved slightly from the upwardly revised level in July. The US consumer confidence index rose to 129.1 in July from an upwardly revised 128.9 in June. Economists had expected the index to fall to 124.9 from 127.3 originally reported for the previous month.

With the unexpected rise, the Consumer Confidence Index reached its highest level since it reached 132.6 in February 2020.

On the coronavirus front: Sydney, Australia's largest city, will remain closed for another month. The New South Wales state government said the lockdown of the city of 5 million people would continue until at least August 28, after reporting on Wednesday 177 new infections in the last 24 hours. This was the largest daily tally since the block was discovered in mid-June. State Premier Gladys Berejiklian told reporters, "I am just as upset and frustrated as all of you that we weren't able to get the case numbers we liked at this time, but it is the reality."

More than 2,500 people have been infected in a group that began when a limousine driver tested positive on June 16 with an infectious delta model. The driver was injured by a US plane transported from Sydney Airport.

South Korea reported a new daily rise in coronavirus cases, a day after authorities imposed strict restrictions in areas outside the Seoul capital region in an effort to slow the spread of the infection nationwide. It announced 1,896 cases on Wednesday bringing the total cases of the epidemic in the country to 193,427, with 2,083 deaths due to COVID-19. It is the highest daily jump since the pandemic began and surpassed the previous record of 1,842 announced last Thursday. The Seoul region was at the epicenter of the outbreak. On Tuesday, the government placed many non-Seoul areas under the second-highest distancing guidelines to guard against the spread of the virus nationwide.

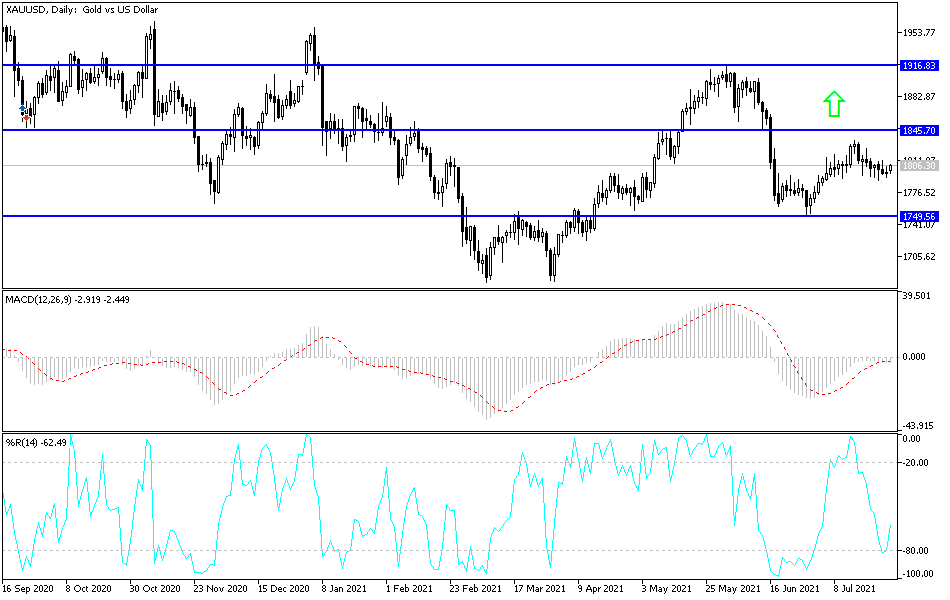

According to the technical analysis of gold: The stability of the gold price above the psychological resistance of 1800 dollars will stimulate buying transactions. Therefore the bulls move towards higher resistance levels, and the closest to them are currently 1819, 1827 and 1845 dollars, respectively. To reach these levels, a strong decline of the US dollar is required. Increasing market fears of an increase in infections with the Corona Delta variable, the return of global restrictions, and more investor appetite for buying safe havens.

The technical indicators on the daily chart are ready to move within the range of an imminent price explosion to the upside if the above mentioned factors combine.

In the event that the US dollar gains a strong momentum from the US Central Bank’s announcement today, the price of gold may be negatively affected, and thus move to the support levels 1786, 1770 and 1755, respectively. All in all, I still prefer buying gold from every bearish level.