In general, a stronger dollar makes gold more expensive for holders of other currencies. The price of gold returned to stability around the level of $ 1812 an ounce at the beginning of trading today, which confirms that any decline in the price of gold will be an opportunity for a return of purchase. The current anxiety in the markets supports the demand for buying safe havens, and gold is one of its most important elements, waiting only for the dollar’s gains to stop. The price of the yellow metal is retreating from a weekly gain of 0.3%, but it is still down about 4% since the beginning of the year 2021 to date.

Declining US Treasury yields helped limit losses for the yellow metal. US Treasury yields are hovering near multi-month lows after US Treasury Secretary Janet Yellen said expectations for a price hike remain weak.

Silver, the sister commodity to gold, fell to $25.06 before paring its losses. The price of the white metal fell 3.5% last week, adding to its 2021 loss of 4.4%.

Markets across Asia and Europe tumbled, and the dollar extended gains as signs of rising inflationary pressures and fears that an uptick in coronavirus cases will have a mitigating effect on the fragile global economic recovery have spurred risk aversion. The number of global coronavirus cases has crossed 190 million as the second wave continues to attack worldwide due to the spread of new variables. Daily infections rose from the United States and Europe to Asia, and a global seven-day average of new cases each day more than half a million for the first time since May.

Investors also remain focused on the European Central Bank's policy update, which meets on Thursday just two weeks after agreeing on its first strategic reform in nearly two decades.

Overall, the outlook for gold weakened on Friday but continued to rise for the fourth consecutive week, buoyed by dovish comments from US Federal Reserve Chairman Jerome Powell and concerns about a slowing global recovery.

Currently, the other main concern for investors is inflation. The annual US inflation rate exceeded 5% last month, while producer prices exceeded 7%. With consumer inflation expectations still rising, some market analysts believe shoppers may stay home in the coming months. With so much chaos in the air right now, investors are also finding shelter in the dollar. The US Dollar Index (DXY), which measures the greenback against a basket of other major currencies, crossed the 93.00 level before paring its gains and slipping into negative territory. The double profit is beneficial for dollar-denominated commodities because it makes them cheaper to buy for foreign investors.

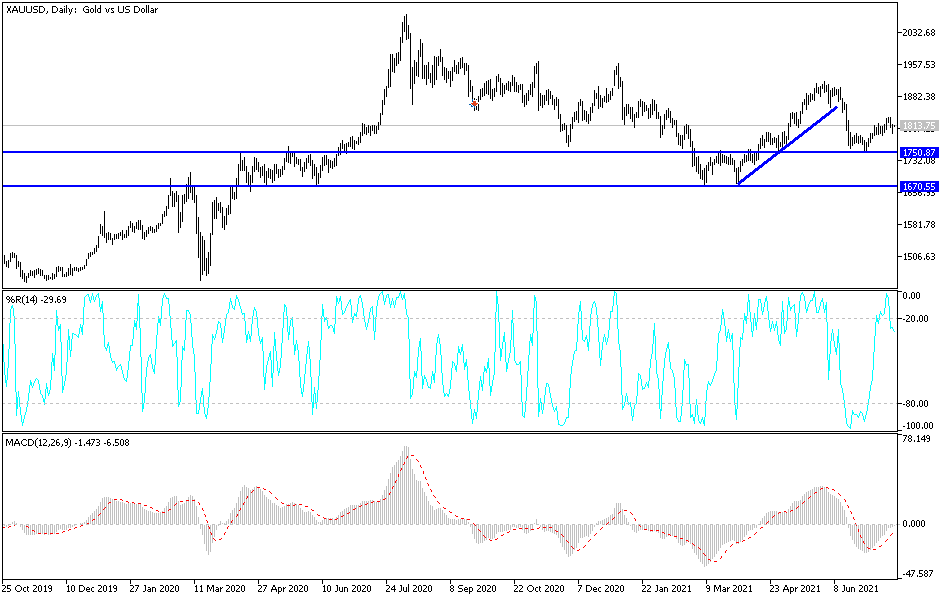

According to gold technical analysis: The stability of the gold price above the psychological resistance level of 1800 dollars is still the most important for gold bulls to rush towards stronger upward levels. The nearest ones are currently 1816, 1827 and 1845, respectively. I still prefer buying gold from every bearish level and the closest ones to bears are currently 1793, 1782 and 1770 respectively. Continuing global concern about the rapid spread of the Corona variable will continue to support the appetite for safe havens, which stimulates the purchase of gold.