This is amid selling operations to the support level of $ 1795 an ounce, which is stable around. The yellow metal is trading in a period of anxiety that dominates global financial markets.

The delta variant of covid-19 has caused concerns in the market amid the rising number of cases. This has affected global stock markets including gold prices. However, on Wednesday, a slight shift towards off-risk trading pushed the price of gold higher.

The price of gold may also rise significantly in the coming days depending on the performance of the US economy. Earlier this week, US building permits for June exceeded the expected (monthly) number of 1.7 million with 1.598 million. On the other hand, the number of housing starts for this period exceeded 1.59 million by 1.643 million.

Currently, investors are vacillating between optimism about the global recovery and unease that it may be delayed by the spread of the more contagious Delta virus. They also worry that central bankers may feel pressure to tame rising inflation by curtailing easy credit.

COVID-19 cases have nearly tripled in the US over the course of two weeks amid an onslaught of misinformation about vaccines that is overwhelming hospitals, stifling doctors, and pushing clergy into battle. Across the United States, the seven-day circulating average of daily new cases over the past two weeks rose to more than 37,000 on Tuesday, compared to less than 13,700 on July 6, according to data from Johns Hopkins University. Health officials blame the delta variant and slow vaccination rates. Only 56.2% of Americans have received at least one dose of the vaccine, according to the Centers for Disease Control and Prevention.

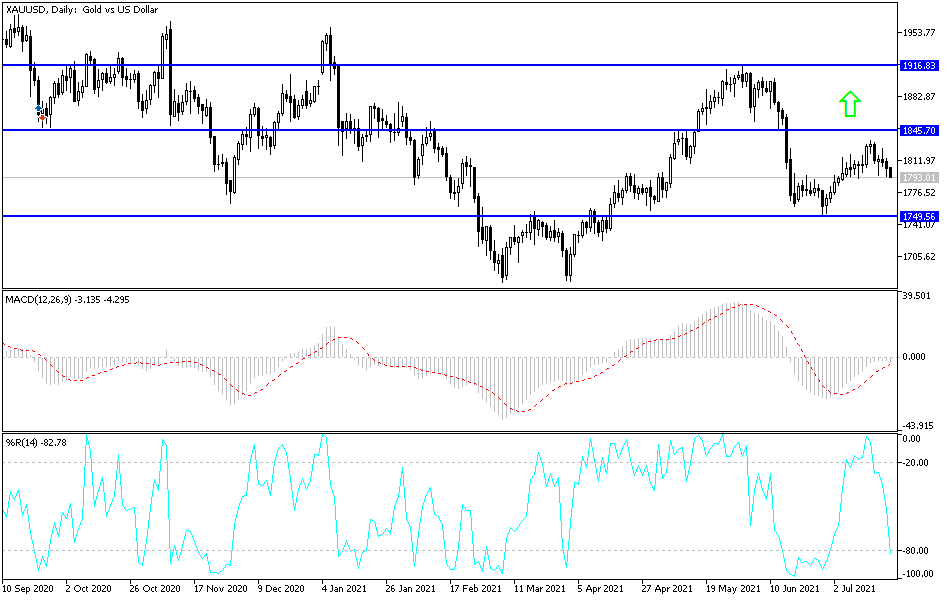

According to the technical analysis of gold prices: In the near term and according to the performance on the hourly chart, it appears that the price of gold XAU/USD is trading within the formation of a descending channel. Gold price rebounded on Wednesday to avoid crossing over to the oversold levels of the 14-hour RSI. Therefore, the bulls will look to ride the current bounce by targeting profits at around $1811 or higher at $1818. On the other hand, the bears will target short-term profits at around $1,794 or lower at $1,784 an ounce.

In the long term, and according to the performance on the daily time frame, it appears that the gold price for the XAU/USD pair is declining after attempting to rebound. It also appears that gold found support from the 100-day moving average after this week's decline. This could lead to the next bounce. Accordingly, the bulls will target long-term profits at around $1,833 or higher at $1,872. On the other hand, the bears will look to extend the current decline towards $1,767 or lower to $1,728 an ounce.

The price of gold will be affected today by the extent to which investors are willing to risk or not, in addition to the reaction from the European Central Bank’s announcement of its monetary policy decisions and the statements of Governor Lagarde, in addition to the announcement of the number of US jobless claims.