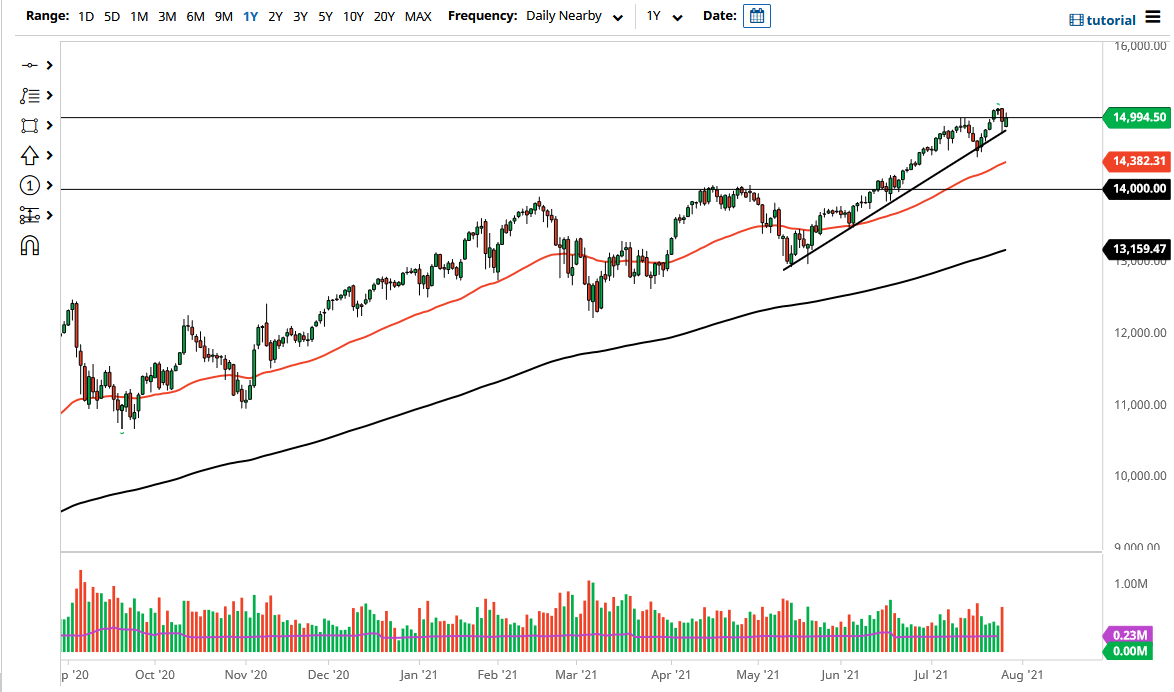

The NASDAQ 100 gapped lower to kick off the trading session on Wednesday as traders continue to have a healthy respect for the uptrend line that had been tested during the previous session. I think it is only a matter of time before we see the markets try to break out towards the highs, and perhaps even make fresh, new highs. After all, it is earnings season for a lot of technology stocks, and that will have a certain amount of influence on the index as there is only a handful of companies that truly move it. With that being the case, I think what we see here is a market that is trying to break out in general, as we have been in an uptrend for some time.

When you look at the uptrend line that I have drawn on the chart, it does not take much in the way of imagination to figure that we are in a significant ascending channel, and we should continue to see plenty of buyers. That being said, even if we are to break down below the uptrend line during the session, it is likely that we would go looking towards the 50-day EMA underneath at the 14,381 level. I believe that the 15,000 level is going to cause a lot of noise, simply because of the large, round, psychological aspect of it.

On a breakdown, as long as we can stay above the 14,000 level, I think that this market will remain very bullish, but you should keep in mind that there will be a lot of volatility. The 14,000 level underneath there would perhaps open up the possibility of buying puts, but I would not sell simply because we know that the Federal Reserve will not allow the market to melt down anytime soon. That is not to say that we cannot break down a bit, but that will only end up being a buying opportunity sooner or later. In general, I think this is a market that will eventually go looking towards the 15,500 level over the next several weeks. Earnings season could in fact be a big driver of that, especially now that Jerome Powell has been relatively dovish during the press conference and in the statement that was given out during the trading session on Wednesday.