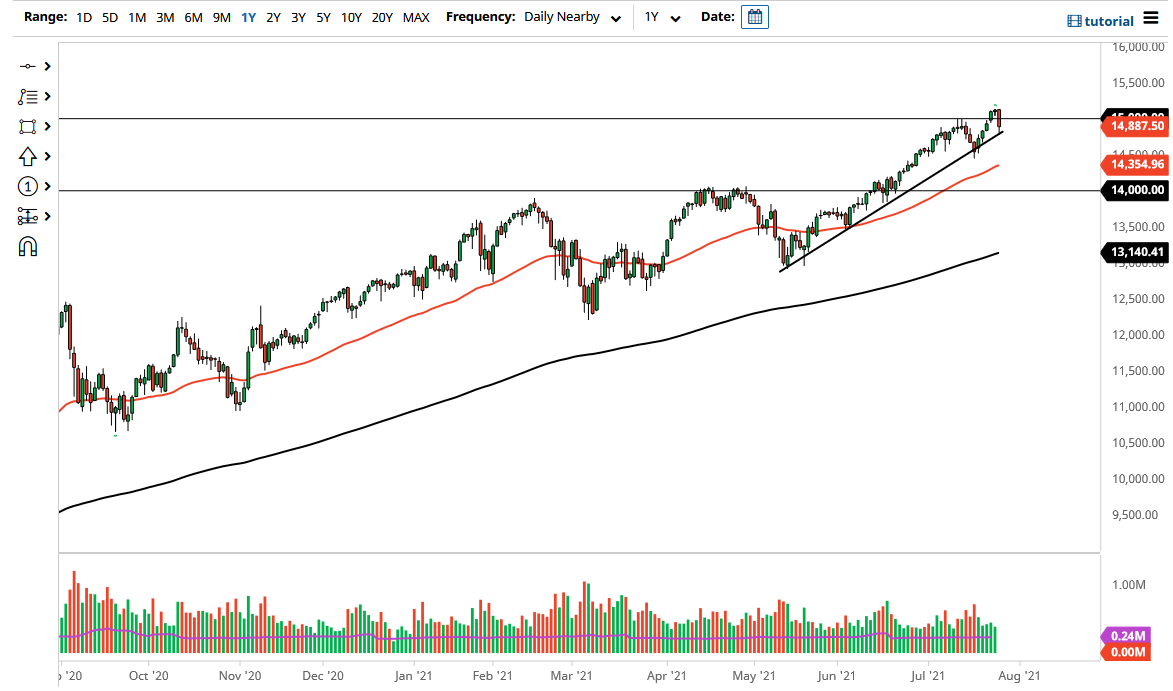

The NASDAQ 100 fell rather significantly during the trading session on Tuesday to reach down towards a major uptrend line that has been a factor in the overall uptrend for some time. That being said, the market looks as if it is trying to figure out what to do going forward as the Federal Reserve has a meeting on Wednesday, and perhaps more importantly, a statement.

The candlestick did close towards the bottom of the range, and that does suggest that we could get a little bit of follow-through. But let us not get ahead of ourselves here, because the Federal Reserve will almost certainly do what it can to pick things up. Looking at this chart, if we were to continue to break down, we could go as low as 14,000, but the 50-day EMA is currently sitting right around the 14,350 level, and that could be a bit of support as well. If we were to break down below there, then the 14,000 level would almost be assured.

Keep in mind that interest rates have an influence on the NASDAQ 100 as well, as the highflying technology stocks tend to do much better in a low interest rate environment as traders go looking towards growth. It should also be noted that there are a lot of technology companies out there waiting to report, and that will have its own influence on this market. Looking at this chart, the market is one that you cannot sell, but if we do break down below the 14,000 level, something I do not see happening anytime soon, then I could be a buyer of puts, but I would not short this market regardless. On the other hand, we could break above the top of the range that we formed during the trading session on Tuesday, and then the market is likely to continue going much higher, perhaps as high as the 15,500 level. It is obvious that the 15,000 level has caused a lot of concern, but ultimately, I think this is a market that will eventually find reasons to go much higher, because that is what it does over the longer term. I have no interest in trying to fight the trend, but timing is everything.