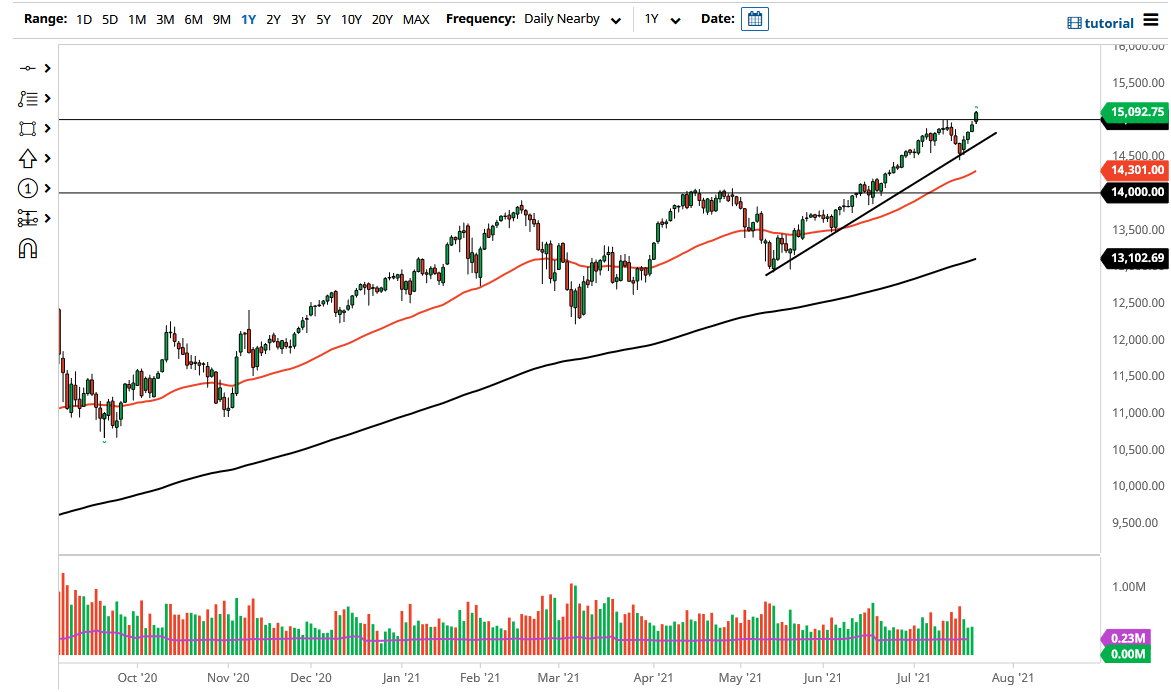

The NASDAQ 100 broke above the 15,000 level in the futures market during the trading session on Friday. Because of this, it looks as if the market is going to continue to go higher, as we are most clearly showing yet another surge in strength. That being said, we might be slightly over-extended at the moment, and I think a pullback here could send this market looking towards the 15,000 level again for some type of “retest.”

Regardless, this is obviously a market that cannot be shorted, especially after the violent reaction we had to the attempt at selling it on Monday. We are in the midst of earnings season, and all of the “Wall Street darlings” continue to attract a lot of attention, namely the ones that push the NASDAQ 100 so much, such as Tesla, Microsoft and Apple. These are all the same names that people use to get involved in the market time and time again, so it does make sense that as the NASDAQ 100 is so heavily weighted to a handful of stocks that it does not take much in the way of upward pressure on these names to get this thing going.

If we go higher, I think that we will probably go looking towards the 15,500 level, but it will obviously take some time to get there. We have had four very strong days in a row, and a little bit of a pullback really does make sense. I think a lot of people will have been surprised by the ferocity of the move and would like to get involved if there is some type of value proposition presented to them.

If we break down below the 14,500 level, I think we could drop as low as the 14,000 level which I now considered to be the “floor in the market”, as it was the scene of a major breakout. The 50-day EMA is at 14,300, so I do not think we will get that far to the downside. Ultimately, the NASDAQ 100 will continue to simply go higher over time, so you can obviously never short this market with any type of real confidence, as we have seen so much in the way of upward pressure over the last 13 years with the massive liquidity measures taken by central banks around the world.