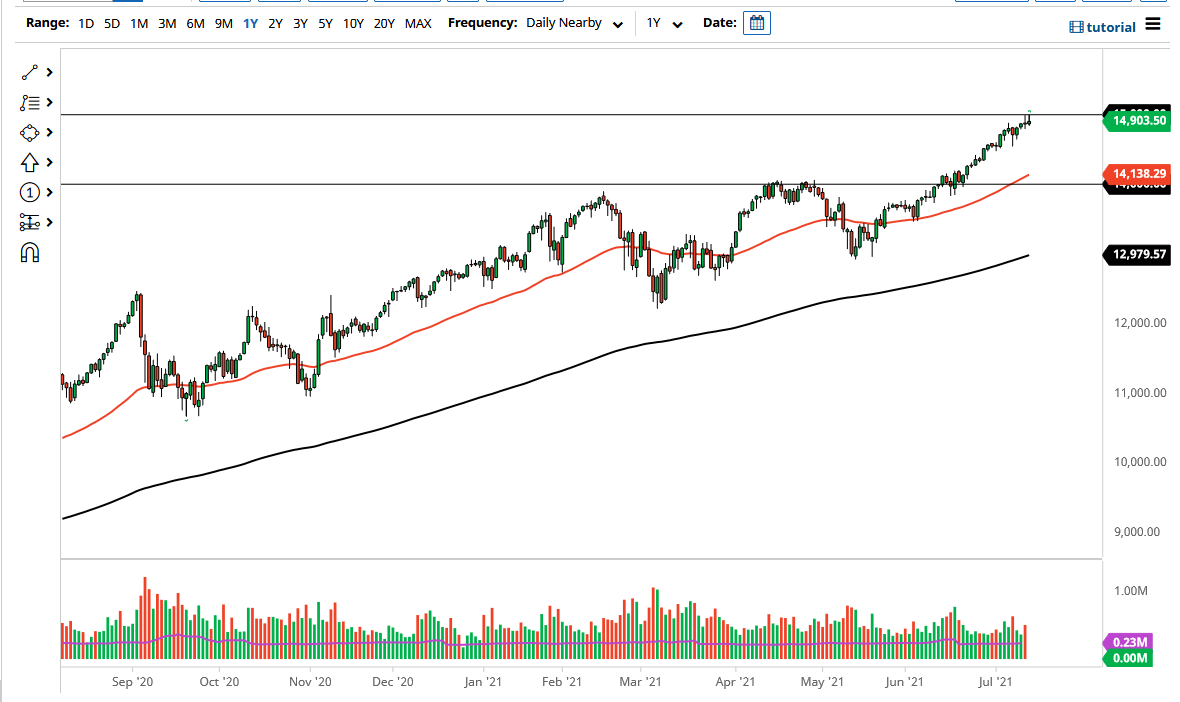

The NASDAQ 100 rallied initially during the trading session on Tuesday to reach towards the 15,000 level. However, just as we had seen during the trading session on Tuesday, the Wednesday session has seen selling pressure at the 15,000 level, and it looks as if we are going to continue to struggle to get above there. With that in mind, it is obvious at this point that a move above the 15,000 level would be significant in the fact that it would be an obvious resistance barrier sliced through. We have been in an uptrend, so most people would think that it should continue at this point.

It is interesting to see how the market has behaved at this level, and I think we may be getting close to a bit of a pullback. A pullback is going to end up being a buying opportunity, perhaps down at the 14,500 level, the 50-day EMA after that, and the psychologically and structurally important 14,000 handle. The 14,000 level is an area we broke out of previously to get to this area, and we have in fact moved to the 15,000 level, just as predicted by the ascending triangle that we broke out of at that point. It is because of this that I think a little bit of a pullback makes sense, but there is nothing on this chart that tells me we are suddenly in danger of falling apart.

At this point, even if we were to break down below the 14,000 level, I would not be short of this market, but I might be interested in buying puts, as the market is one that you cannot sell, as the Federal Reserve will step in and continue to support the market given enough time. By buying options, you have the ability to mitigate your risk, and still participate to the downside. That being said, we are at least a thousand points away from even considering that situation. If we do break to the upside, the 15,500 level is the next major target, followed of course by the 16,000 level as this market does tend to respect 500-point increments one way or the other. If interest rates continue to drift lower, that could help the major companies in this index drive the NASDAQ 100 higher as well.