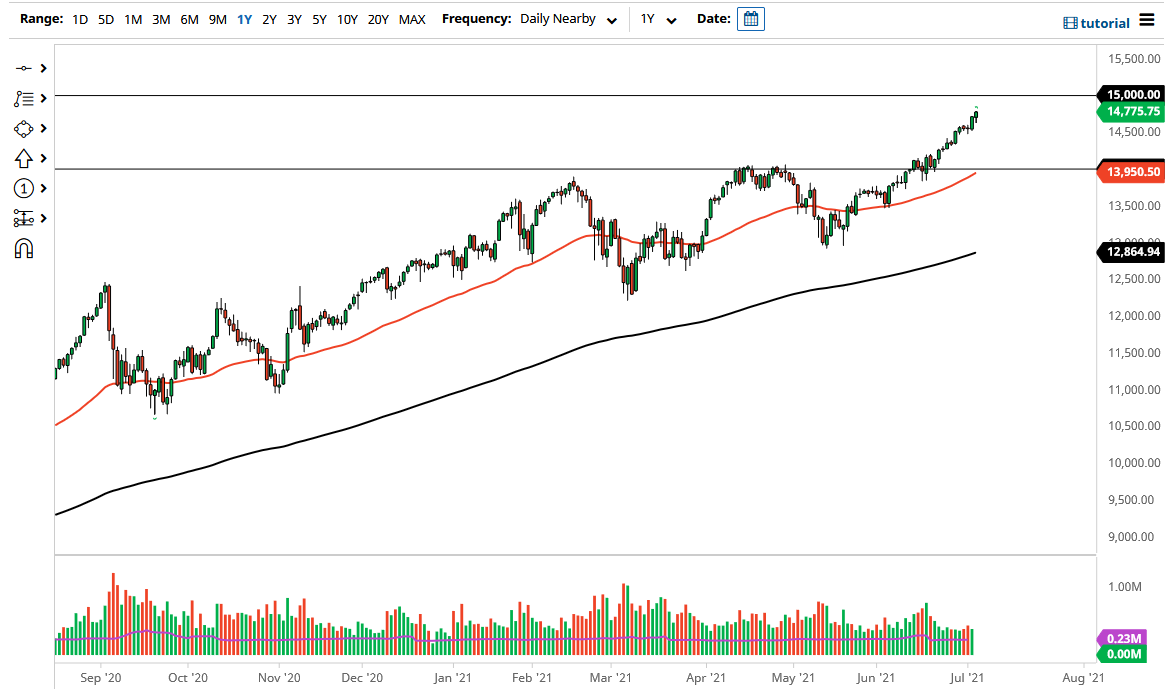

The NASDAQ 100 initially fell during the trading session on Tuesday but found enough support underneath to turn around and rally yet again. At this point, the NASDAQ 100 is clearly making a bit of a beeline towards the 15,000 level, which is a large, round, psychologically significant figure. The market will certainly be looking at that as a target, and it could also offer massive amounts of short-term resistance. Nonetheless, large round figures eventually get broken and I would anticipate more of the same here.

That being said, we are a little bit stretched, so we might be due for a little bit of a pullback. That pullback should be an opportunity to pick up value on a dip, with the 14,500 level being a particularly interesting area to pay attention to, followed by the very obvious 14,000 level, which is not only the scene of the most recent breakout, but it is also where the 50-day EMA is currently reaching towards. Speaking of that 14,000 level, the 50-day EMA is reaching towards that as well, so I think it gives yet another reason to believe that it should hold up as support.

When you look underneath the 14,000 level, you can see there is a bit of an ascending triangle that we broke out of, which measures for a 1000-point move. That ties in quite nicely with the idea of a move to the 15,000 handle as well, so at this point that is what I am sticking with. The fact that the market closed at the very top of the range also shows you which direction we are going, as traders were more than comfortable enough to go home with bullish positions on.

As far as selling is concerned, I have absolutely no interest in doing so, because I do not have any interest in trying to fight the Federal Reserve. If the market falls too quickly, the Federal Reserve will either say or do something to save it, despite the fact they claim they will not. This is what they have been doing for 13 years, and I just do not see that changing at this point in time. With yields dropping, it also gives a bit of a boost to technology stocks, so the NASDAQ 100 probably leads the way higher overall.