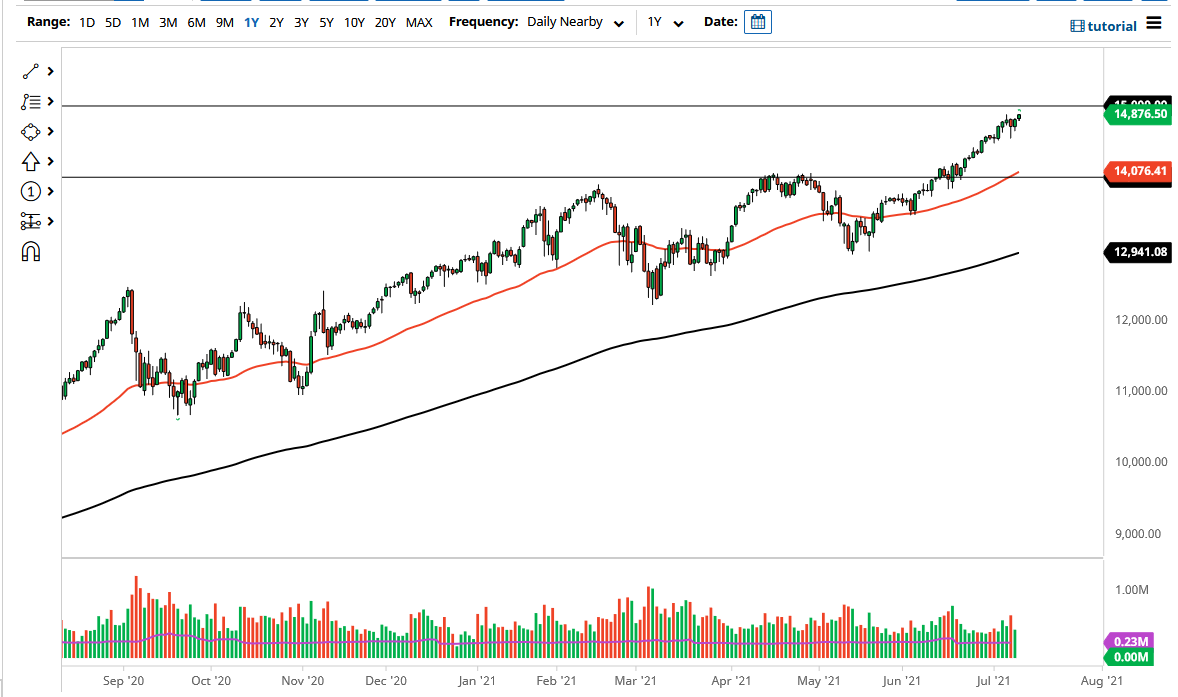

The NASDAQ 100 rallied again during the session on Monday as we continue to look towards the 15,000 level above. The 15,000 level has a large psychological aspect to it that I think will cause a lot of headlines. With this, if we can break above the 15,000 level then it is very likely that the market will continue to go higher, breaking out to a new uptrend. Whether or not we can continue to go straight up in the air is a completely different question, but I would anticipate that there are a lot of options barriers in that general vicinity.

To the downside, I believe that the 14,500 level should offer a certain amount of support, just as the 14,000 level will. The 14,000 level is an area that is crucial overall, as it is not only a large, round, psychologically significant figure, but it is also where we see the 50-day EMA. Perhaps even more importantly, is an area where we had broken out of previously after forming a bit of an ascending triangle. That ascending triangle measures for a move towards the 15,000 level, and we have almost filled that.

If we were to turn around and breakdown below the 14,000 level, then I might be a buyer of puts, but I would not short this market regardless, because this is a market that goes straight up in the air rather rapidly. It is also led by a handful of everybody’s favorite technology stocks, so it is a very difficult and dangerous thing to short. With that being the case, the market is more likely to go up than down, so if we were to get any type of significant pullback from here, it should be thought of more or less as a buying opportunity. After all, interest rates are relatively low on the 10-year yield, and that normally has people looking to buy growth stocks which are the bread-and-butter of the NASDAQ 100. We should go higher given enough time, but do not be surprised at all if we see a little bit of noise just above at this big figure that will attract a lot of headline attention more than anything else.