That does make a certain amount of sense though, because the large technology growth stocks tend to do fairly well in a low interest-rate environment, which is exactly what we are seeing. The market should continue to pay close attention to the 10 year yield, because the 1.25% level is coming into focus, and that is an area that will garner a lot of headlines.

The fact that the candlestick forms a little bit of a hammer suggests to me that there are buyers underneath, but that does not necessarily mean that we cannot fall again. In fact, even though we did recover quite nicely during the session, a lot of “weak hands” will have been shaken out, and therefore we may have further to go. Beyond that, there does come a point where the yields in the 10 year get to be a bit too much, and then the market sells everything off as it is a bit panicky. I do believe that the next couple of sessions are going to be important, because nerves are certainly starting to get frayed.

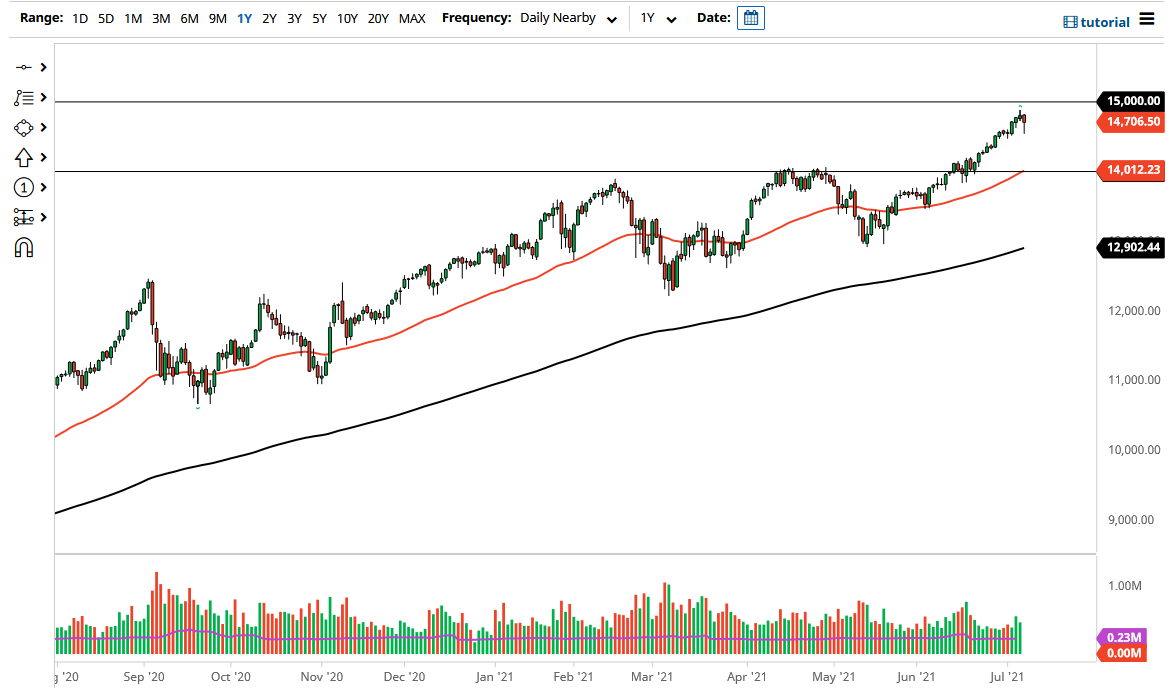

To the upside, I would anticipate that the 15,000 level should offer a significant amount of resistance, and of course will attract a lot of headlines in and of itself. If we can break above that level, then it is likely that the market could go much higher, perhaps opening up the door for a move to the 16,000 handle. I still believe that the NASDAQ 100 is a “buy on the dips” type of market, but I am not completely convinced that the move in the bond market is over, and therefore I might be a bit cautious. I do not necessarily want to hold anything into the weekend until we get a bit of clarity when it comes to risk appetite. Just about anything could happen over the weekend, and this one seems to be especially susceptible to trouble, as further lockdowns anywhere would probably cause chaos as people begin to worry about the recovery. That being said, the market was a little overdone, so a pullback is welcome news and probably necessary anyway.