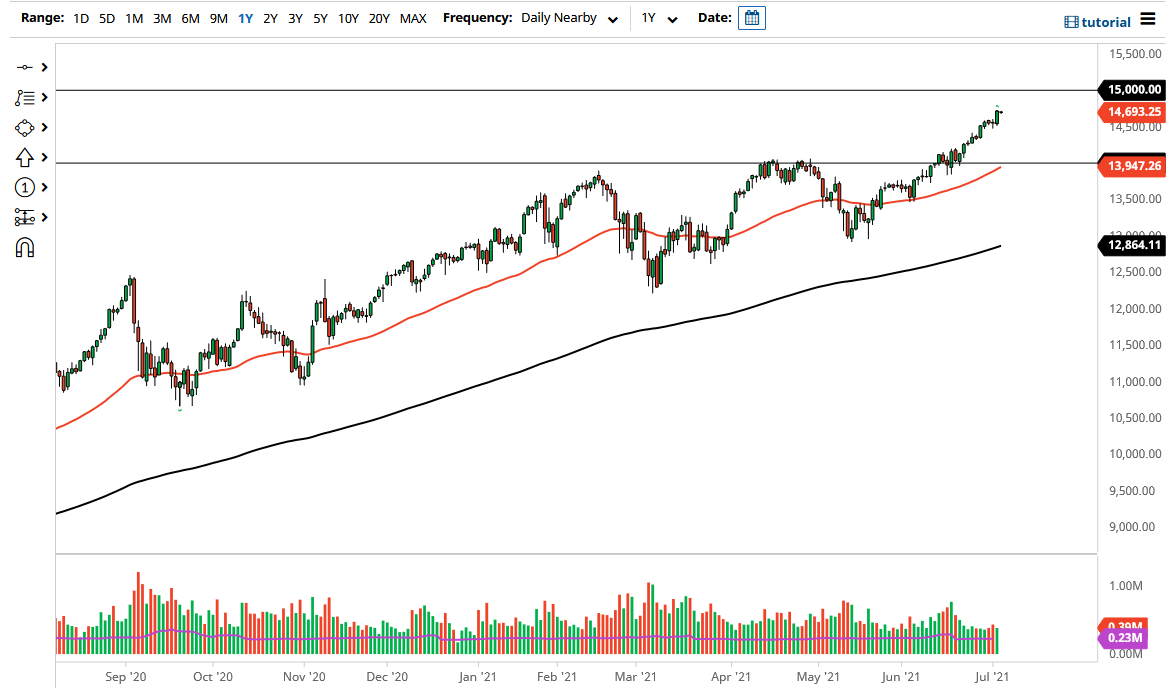

The NASDAQ 100 futures market was open for electronic trading on Monday, but there was very little in the way of volume, so you would think that almost nothing could be read out of the candlestick from the Monday session. That being said, the Friday candlestick was very bullish, and I think we will more than likely see a little bit of follow-through to the upside.

I would look at this market through the prism of buying on dips, because they offer value. The “bottom” is probably closer to the 14,000 level right now, but I think the 14,500 level should also offer significant support. On the other hand, if we were to break above the highs of the Friday candlestick, then it is very likely that we could go looking towards the 15,000 level, which is my target at the moment. At this point, I think it will probably cause a bit of selling pressure, but eventually we should break through there. This is mainly due to the idea of the market shifting from “value” back into “growth stocks.” This means companies like Facebook, Microsoft, Alphabet and Tesla will start to attract more money. If that is going to be the case, then it is likely that we will continue to see the NASDAQ 100 rise, as it is so heavily influenced by this handful of technology giants.

I like the idea of buying dips, because it gives you an opportunity to pick up value in a market that is obviously bullish. I anticipate that the 15,000 level above is going to cause a significant amount of resistance, but eventually we will break through there and then 15,000 should end up being a major floor in the market.

The alternate scenario is that we break down below the 14,000 level, which would be quite a feat from this level. Having said that, nothing is impossible and, if we do that, then I anticipate that the market could drop another 500 points or so where it should find even more support and buying pressure underneath. Currently though, I have no interest in shorting the NASDAQ 100 as it certainly looks extraordinarily bullish, and the momentum is most certainly in the hands of the buyers of this index.