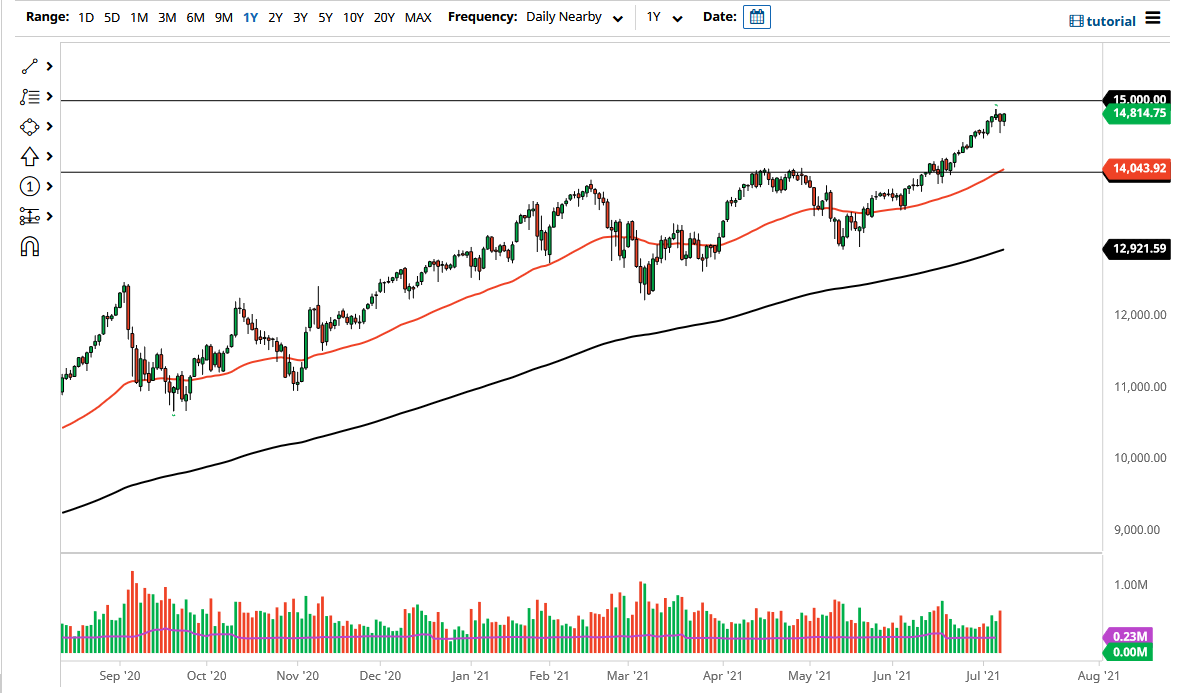

The NASDAQ 100 initially fell during the trading session on Friday only to turn around and find plenty of buyers. At the end of the day, we ended up at the top of the session, suggesting that we could see a continuation. A break of the past couple of candlesticks could open up the possibility of testing the 15,000 level, which is a large, round, psychologically significant figure.

If we were to break above the 15,000 level, then it is likely that we could continue to go much higher, based upon the breaking of a major round figure. That opens up a lot of psychological pressure to the market as we could go higher. To the downside, the 14,500 level is a significant support level from a mid-century standpoint, and of course psychologically. Underneath there, then there is even more support at the 14,000 level. The 14,000 level is an area that previously had been resistance and should now be support.

The 50-day EMA is also starting to reach towards the 14,000 level and is rising. That should offer plenty of support, and it is likely that the market will continue to respect that as it has multiple times in the past. If we were to break down below the 14,000 level, I might be a buyer of puts at that point, but I would not short this market flat out due to the fact that the Federal Reserve is likely to manipulate the market higher, as they do not like the markets falling too quickly. By using puts, you can mitigate a lot of your losses and, by extension, risk. This remains a “buy on the dips” type of situation, and I simply do not see that changing anytime soon.

Furthermore, if we continue to see yields fall in America, that also would be good for the NASDAQ 100, as the growth technology stocks that tend to push the NASDAQ 100 will come into favor again. As long as there is cheap money or low rates, or even better yet both, the NASDAQ 100 should continue to do what it has done for the last 13 years. Ultimately, this is a market that should continue to see plenty of momentum chasing, and it is only a matter of time before we break the 15,000 level.