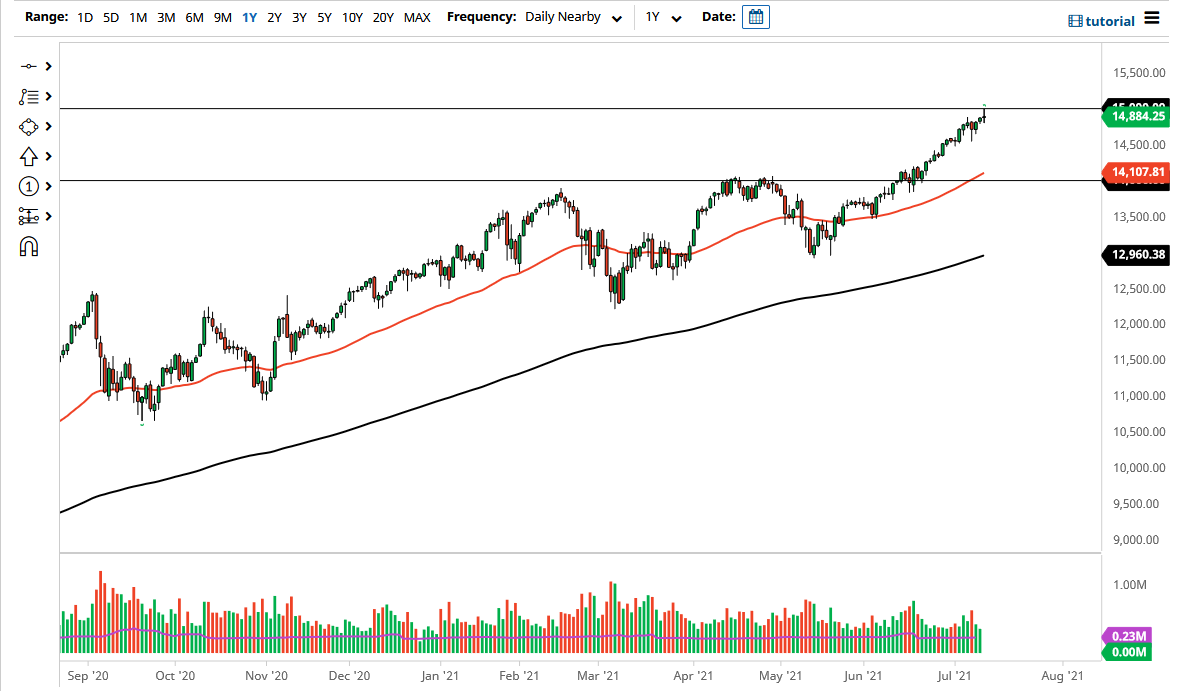

The NASDAQ 100 shot higher during the trading session on Thursday as we went looking towards the 15,000 level. The 15,000 level is a large, round, psychologically significant figure, and it makes sense that there would be a little bit of hesitation there. Furthermore, underneath the trading range that we are in right now, we had previously been in an ascending triangle that measures for a move of 1000 points. On the breakout at the 14,000 level, that measures for a nice tidy move to the 15,000 handle.

If you paid attention to my analysis yesterday, I suggested that perhaps the NASDAQ 100 might go looking towards higher levels, to test that 15,000 barrier. I also suggested that it could cause a bit of noise, due to the fact that the round figure tends to attract a lot of attention and options barriers. The fact that we pulled back a bit to form a bit of a shooting star should not be a huge surprise, so I think at this point we are more than likely to see plenty of value hunters underneath. Obviously, we are in a very strong uptrend, so I have no interest whatsoever in trying to short this market, especially as the Federal Reserve will get involved if we fall too far.

Interest rates did rise during the trading session in the 10-year note, and that tends to work against technology stocks in general, as people start to look towards growth stocks and beat down the value stocks. At this point, I believe that we should see plenty of support underneath at the 14,500 level, or perhaps even down to the 14,000 level. On the other hand, if we were to break above the top of the shooting star and clear the 15,000 level on a daily close, then I think that this market has quite a bit of room to run. We are a little extended at this point, so it would not be a huge surprise to see this market pull back as a result. With this in mind, I am looking for value at lower levels on signs of support that I can take advantage of, or I would consider buying on a daily close above that huge figure that we failed at during the day on Tuesday.