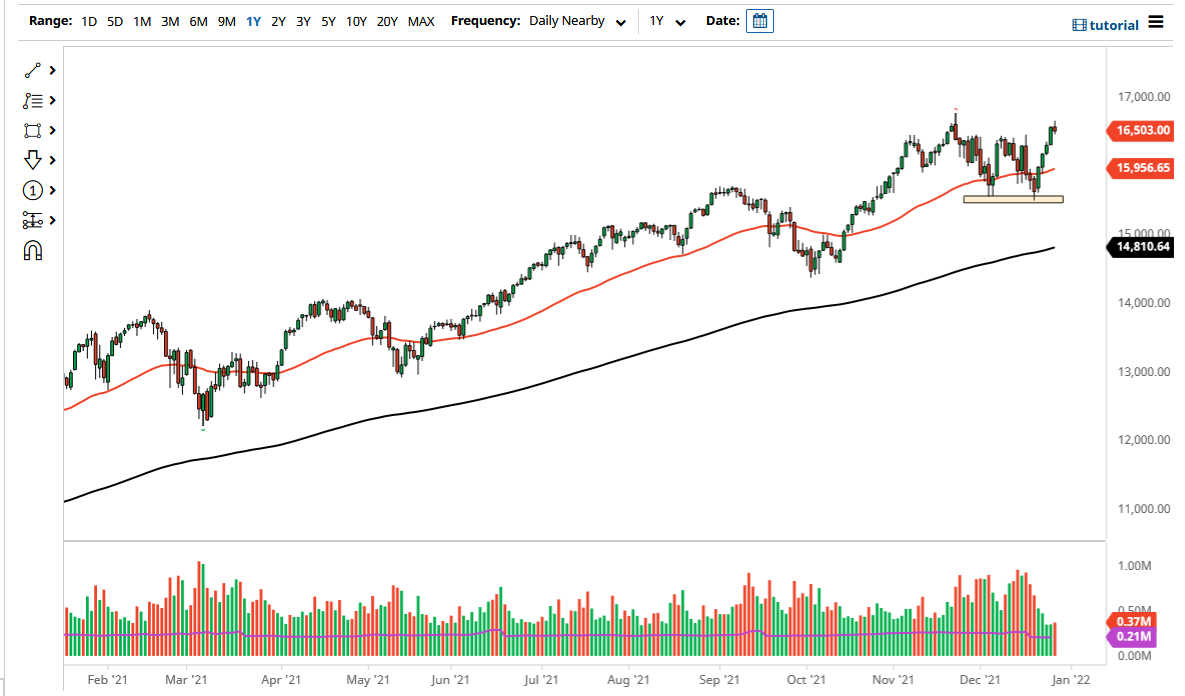

The NASDAQ 100 has rallied significantly during the course of the trading session on Thursday as we continue to look towards the previous all-time high. At this point, the market looks as if it is trying to break out, and it should be noted that the 15,000 level is of course crucial. After all, it is a large, round, psychologically important aspect built in as it will certainly capture a lot of attention. If we were to break above there, then it is likely that we could go much higher, perhaps reaching towards the 15,500 level initially.

To the downside, we could see a little bit of a pullback to reach towards the previous uptrend line underneath, as we have seen all of the losses wiped out, and now it is really only the psychological resistance that continues to be an issue. Pay close attention to interest rates, because if they continue to drop it is likely that the NASDAQ 100 might be a big winner, due to the fact that so many of the moves are driven by just a handful of major technology companies which thrive in a low interest-rate environment. It is all the usual “Wall Street Darlings”, such as Facebook, Alphabet, Tesla, etc. In other words, it is the same story we have seen over the last 13 years.

I have no interest whatsoever in shorting this market, and therefore I think that the market is likely to continue to see value hunters coming back into the marketplace and picking up this market every time we see support. All things being equal, if we break down below the uptrend line then it is likely that we will go looking towards the 14,500 level underneath, and then possibly even the 14,000 level after that. The 14,000 level would be where I would be buying puts because I think it would be a significant break down just waiting to happen. However, that does not look very likely to be the case, so therefore I think we are going to continue to see the NASDAQ 100 rise due to the low interest rates, and of course the fact that the Federal Reserve is going to protect Wall Street any time there is the slightest hint of a major breakout. Eventually this game ends, but it has worked for the last 13 years and I suspect Friday will not be any different.