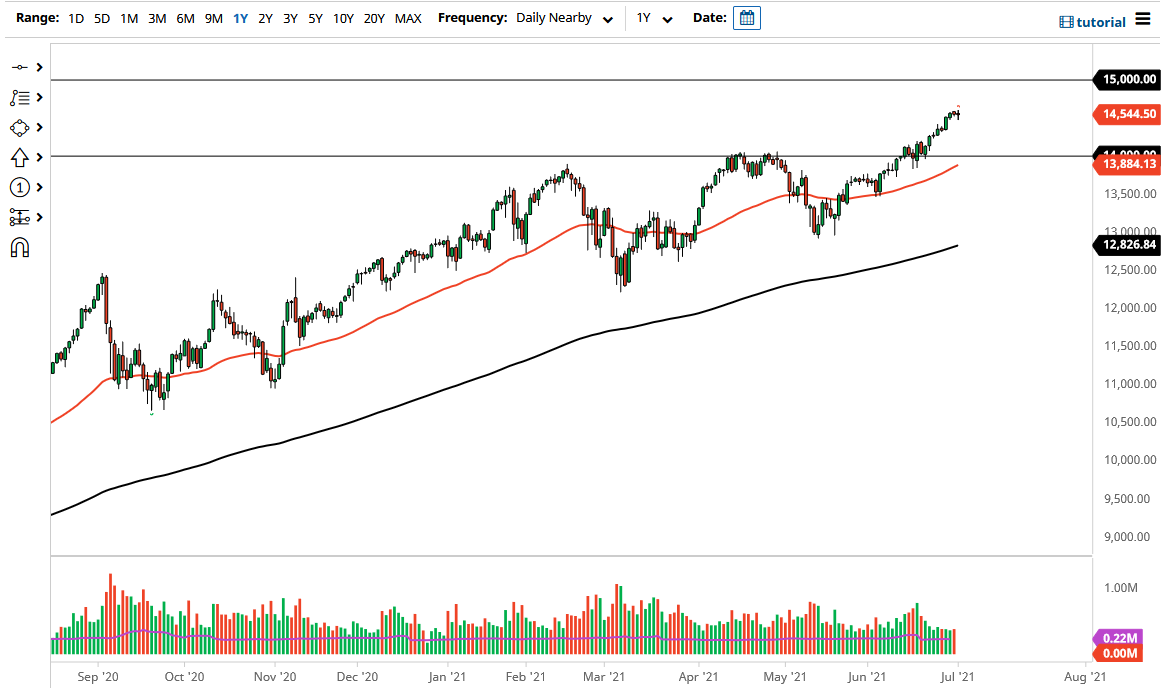

The NASDAQ 100 has done very little during the trading session on Thursday, as we continue to see a lot of upward pressure overall, but perhaps we are taking a bit of a breather heading into the jobs number on Friday. It should not be a surprise that we have found a bit of an anchor to the 14,500 level, because it is a “midcentury mark.”

To the downside, I anticipate that the 14,000 level will continue to offer support, especially as the 50 day EMA is racing towards it. The 50 day EMA of course has offered a bit of support in the past, so I think it is interesting to note that we are seeing it reach towards that crucial 14,000 level at the same time. With that being the case, think it is only a matter of time before buyers would come in and try to take advantage of any type of value that appears, especially as the market has been in such a strong uptrend.

Looking at the bigger picture, I can see that the 15,000 level above is a juicy psychological target that a lot of people will be paying attention to, and therefore I think it is only a matter of time before we reach it. I look at any knee-jerk reaction to the downside after the jobs market probably gets bought into, because Wall Street has a huge ability to come up with some type of narrative to make the market go higher. With this, the market is likely going to continue to see more upward pressure than not, especially as we have been moving towards the growth stocks again, which of course are all of the usual suspect such as Facebook, Microsoft, Tesla, etc.

Just as with the S&P 500, I have absolutely no interest whatsoever in trying to short this market, because the Federal Reserve will step in and say or do something to make the market rally again. If we do break down below the 14,000 level, might be a buyer of puts, but it would be short-term duration only. For the longer term, I think that the 15,000 level will offer significant resistance, so it may take quite a bit of effort to get beyond it. With that, I remain bullish, but I also recognize that there will be a lot of work to do eventually.