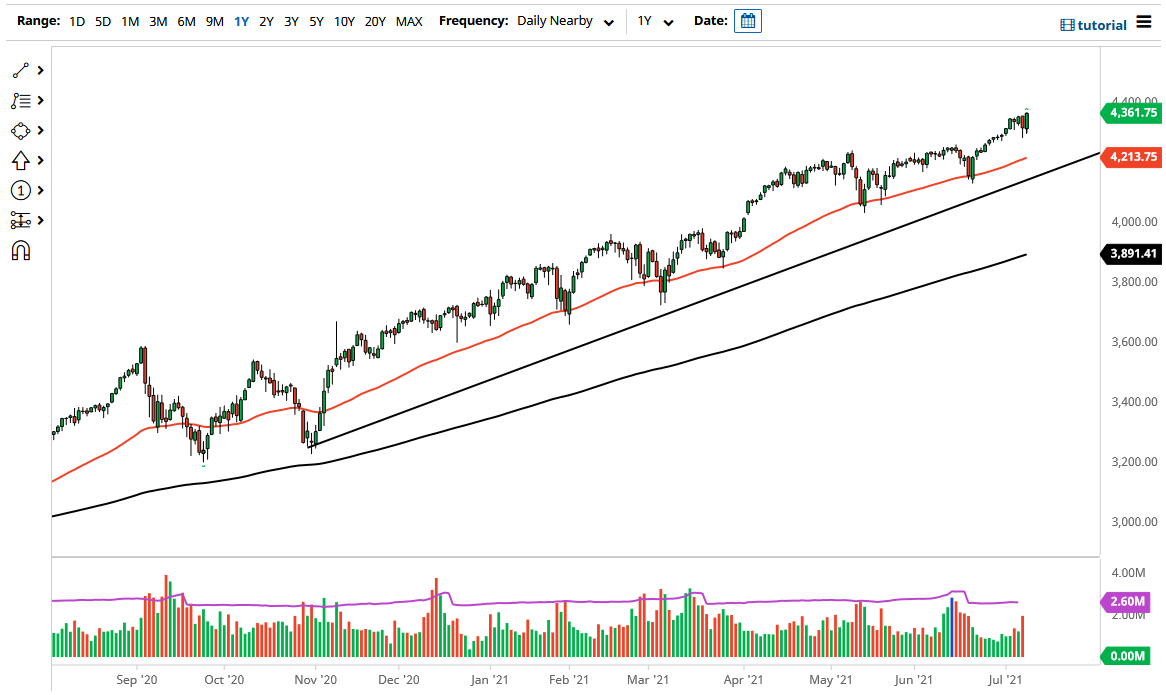

The S&P 500 initially fell during the trading session on Friday only to turn around and break out to a fresh, new all-time high. This is a market that has been rallying for quite some time, and at this point I think we are going to continue to see plenty of momentum. In fact, if you have been following me for a while, you know that the 4400 level is a target that I have been looking at. The S&P 500 tends to move in 200-point increments from a technical analysis standpoint, so that lines up quite nicely.

I think we will even break above the 4400 level, and then eventually go looking towards the psychologically important 4500 level. I would anticipate a little bit of noise in that area, but it will be blown through just as some of the other bigger figures like the 4000 psychological barrier got crushed through. When you look at the chart, you can also see that the 50-day EMA is sitting above the 4200 level and tilting higher. It is a moving average that typically is followed, and there is an uptrend line underneath that continues to lift everything as well.

As long as money is cheap and the Federal Reserve is out there flooding the markets with liquidity, the S&P 500 will probably continue to go higher. Bond yields rose a bit during the trading session, signaling that perhaps not as many investors were willing to jump into paper in order to protect trading capital. That gave people a little bit of a boost to the upside, but at the end of the day I think there are a lot of questions out there when it comes to whether or not there is going to be any growth.

In the short term, it certainly looks as if the market has further to go to the upside. We all know that the Federal Reserve will talk it back up if there is some type of break down, especially if it is something that happens rather quickly. This engulfing candlestick is a good sign, and I think that we could continue to go higher. However, that does not necessarily mean that you should just jump in with both feet. I think picking up little bits and pieces along the way on dips would be the best way going forward.