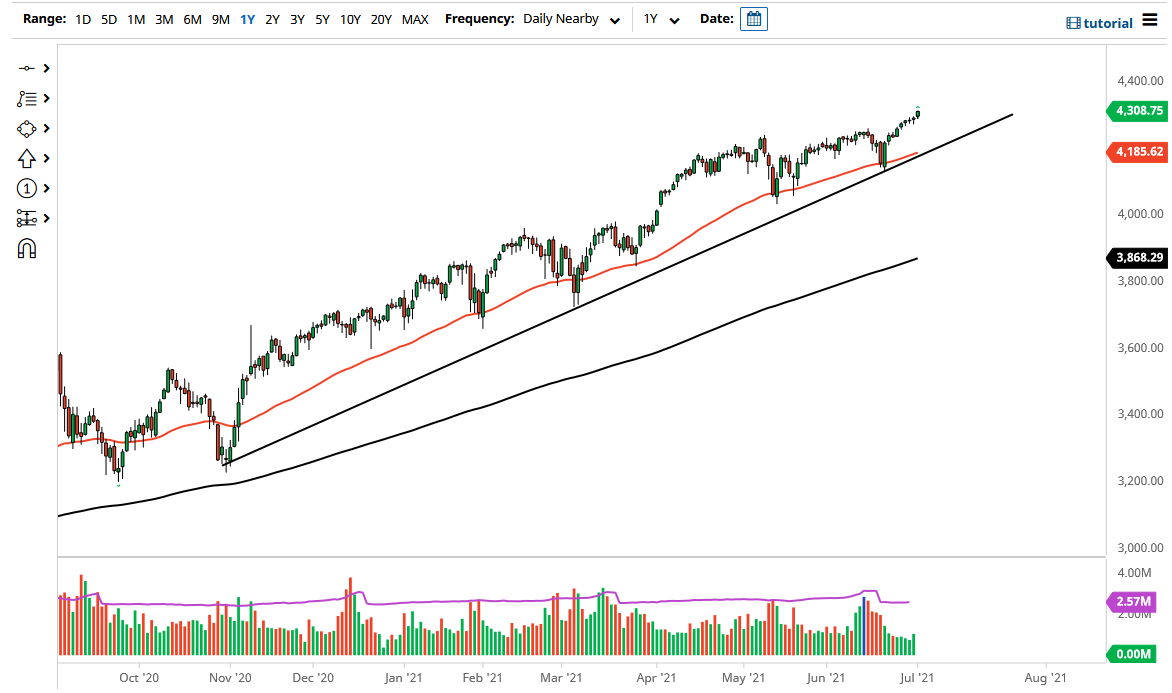

The S&P 500 continues to look very bullish, as we have power it higher during the trading session on Thursday, heading towards the Friday jobs number. At this point, the market looks very likely to continue to see the market reaching towards the 4400 level above, as this market does tend to move in 200 point increments.

Pullbacks at this point in time should continue to be buying opportunities as we have plenty of support underneath, especially near the 4250 handle, where we had recently seen a bit of resistance. Beyond that, we also have the 50 day EMA as well as the uptrend line just below that that are going to offer plenty of support as well. Because of this, I like the idea of looking at that area as potential support, but I do recognize that we may not even get down there. With the jobs number coming out on Friday, it is very likely that the index might be a bit noisy to say the least, with a more bullish attitude than anything else but we could get a bit of a pullback due to the initial “knee-jerk reaction” that we might get. I would be a buyer of dips and have no interest in shorting. However, if we break down below the 50 day EMA and the uptrend line, that could lead to a bit more selling.

At that point, I would anticipate that the market will more than likely have plenty of support near the 4000 level as it is a large, round, psychologically significant figure and of course an area that will attract a lot of headline attention. Looking at the 4000 level, there is also a significant gap that sits in that region and of course the 200 day EMA is starting to race towards that area as well. It is not until we break down below the 4000 level that I would be a buyer of puts, but that is about as negative as I would get in this market as the Federal Reserve is going to step in and do whatever it can to lift the market. Ultimately, I think this is a market that continues to see more upward pressure than down and therefore if we do dropped during the jobs number, I may pick up a little bit on the way back up.