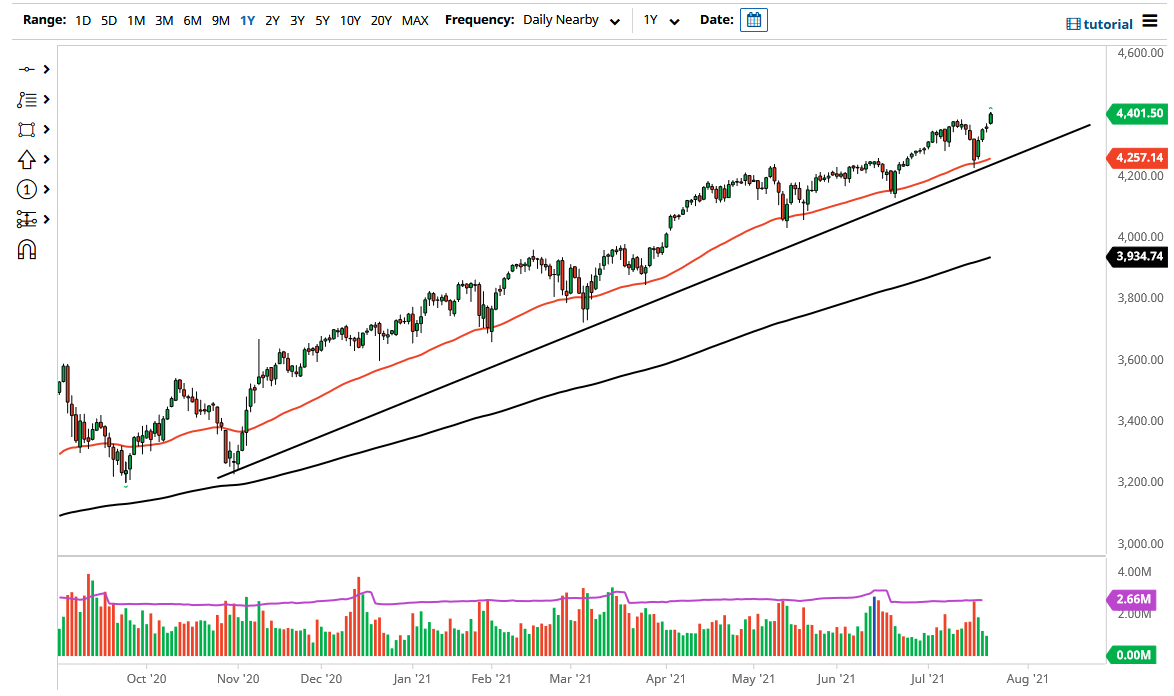

The S&P 500 rallied yet again during the trading session on Friday as we closed right around the 4400 level. This is a market that seems to have no fear built into it whatsoever, and I think what we are probably going to see is a “buy on the dips” scenario, as market participants will more than likely continue to find reasons to get long. Beyond that, we also have the earnings season going on right now, which has a major influence on what happens next. As long as earnings continue to beat expectations like they have been, I anticipate that the S&P 500 wil lcontinue to rally.

The fact that we closed at the very top of the range during the trading session on Friday also suggests that traders are comfortable going home for the weekend long of the market, meaning that there is a significant amount of confidence in the market right now. This makes sense considering how ugly things were on Monday, as we crashed into the 50-day EMA and the uptrend line. By the end of the day Tuesday, we had wiped out all of the losses, and then shot higher yet again. This is a market that is being driven higher by liquidity as well, so it is almost impossible to think of a situation in which I would be short of the market anytime soon.

If we break down below the 4200 level that would obviously be a nasty turn of events, but I do not think that will happen any time soon. The 4000 level is essentially what I considered to be the “floor the market” as the 200-day EMA is reaching towards that area and it is a large, round, psychologically significant figure. That is an area where there would be a lot of options barriers as well, so it is not until we break down below there that I would worry about the overall uptrend. At that point, I might be a buyer of puts, but that is as bearish as I get in a market that is so highly manipulated by liquidity measures and simple talking points coming out of the Federal Reserve.