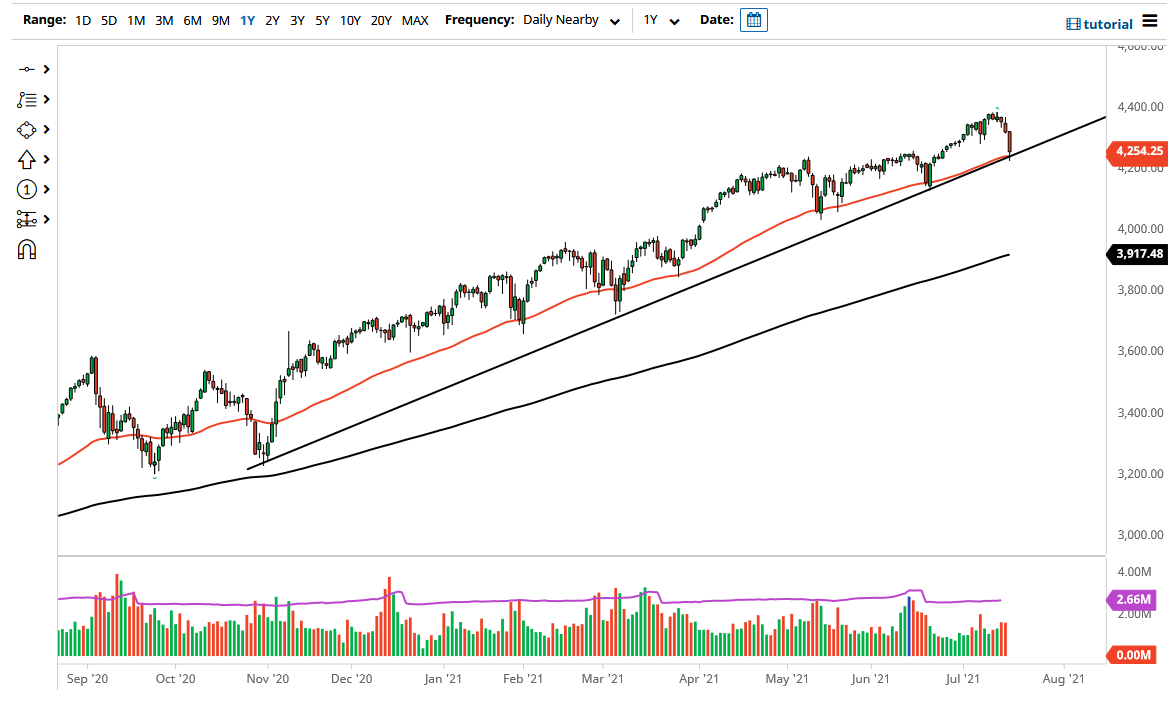

The S&P 500 fell hard during the trading session on Monday to show signs of exhaustion, as the markets have gotten a bit ahead of themselves. Furthermore, we have seen a massive drop in yields on the 10-year note, which has Wall Street freaking out. At this juncture, the S&P 500 is sitting right on the 50-day EMA and the massive uptrend line that has held the market in check for some time, so the question now is going to be whether or not we can continue.

If we break down below the bottom of the candlestick for the trading session on Monday, then it is likely that the market will continue lower. That does not necessarily mean that we are going to have a massive meltdown, but perhaps something along the lines of a substantial correction. That would not be a bad thing necessarily, because it gives you the ability to pick up a bit of value. Underneath, I see the 4200 level as the initial support, but I think it is much more important that the market stays above the 4000 level than anything else.

The 4000 level features a gap which is something that people will pay close attention to, not to mention the fact that the 200-day EMA is starting to reach towards that area. Beyond that, there is a significant amount of psychological importance attached of that figure, so I think that is essentially what we are looking at as the “floor in the market.” Furthermore, that would be a 400-point drop from the highs, which would work out quite nicely to a roughly 10% drop, which is common as far as corrections are concerned.

If we do turn around from here, we need to wipe out the losses from Monday in order for the market to get bullish again, or perhaps maybe just walk along the uptrend line in a very slow crawl in order to build up the necessary inertia to go higher. The US dollar calming down could also help this market, but the greenback looks very strong as the bond market continues to attract a lot of attention.