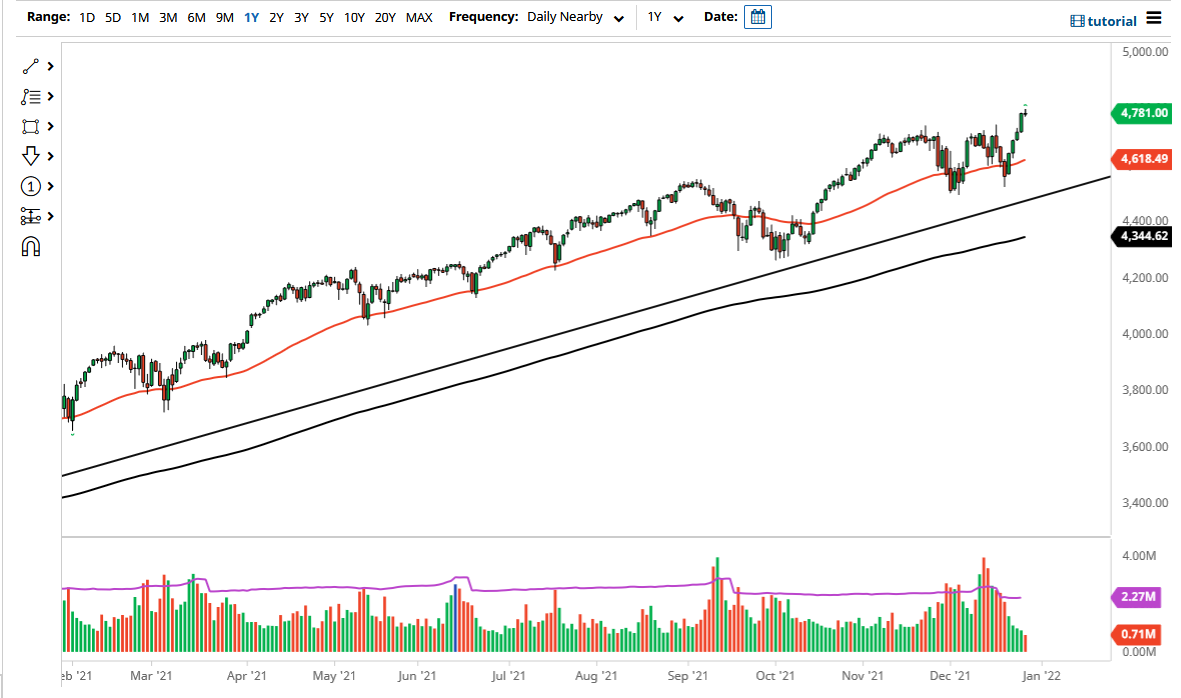

The S&P 500 has rallied a bit during the course of the trading session after initially dipping, as we continue to see a lot of bullish pressure, wiping out a lot of the losses over the last couple of days. It is also worth noting that the VIX continues to drop and is at a very low level to begin with, so ultimately this is a market that is simply going to continue to go higher on dips.

If we can break down from here, it is likely that the 50 day EMA and the uptrend line both come into the picture, as it is a significant support level over the last several months, and therefore it is only a matter of time before the buyers get involved. Ultimately, if we break down below the uptrend line and the 50 day EMA, then it is obvious that the market would go looking towards the 4200 level, and then possibly even the 4000 level where I see a gap in the market. The 4000 level should be the “floor the market”, as it is a large, round, psychologically significant figure and an area that would mark a 10% loss in the market which is a typical correction. Furthermore, you should also keep in mind that the 200 day EMA is reaching towards that area, and as a longer-term bullish signal.

The market was to break down below the 4000 level so I think it is only a matter of time before the market breaks down rather significantly and I would be a buyer of puts at that point as it would open up the possibility of profiting from a drop, but that way I will not have to actually short the market as it is difficult to fight the Federal Reserve as the central bank is going to protect Wall Street as it is its number one job. We will eventually find plenty of buyers on a dip assuming that we are going to simply go higher and break above the 4400 level. If we do that, then the market is likely to go looking towards the 4500 level. I am bullish, but I also recognize that we may be a little overextended in the past 72 hours.