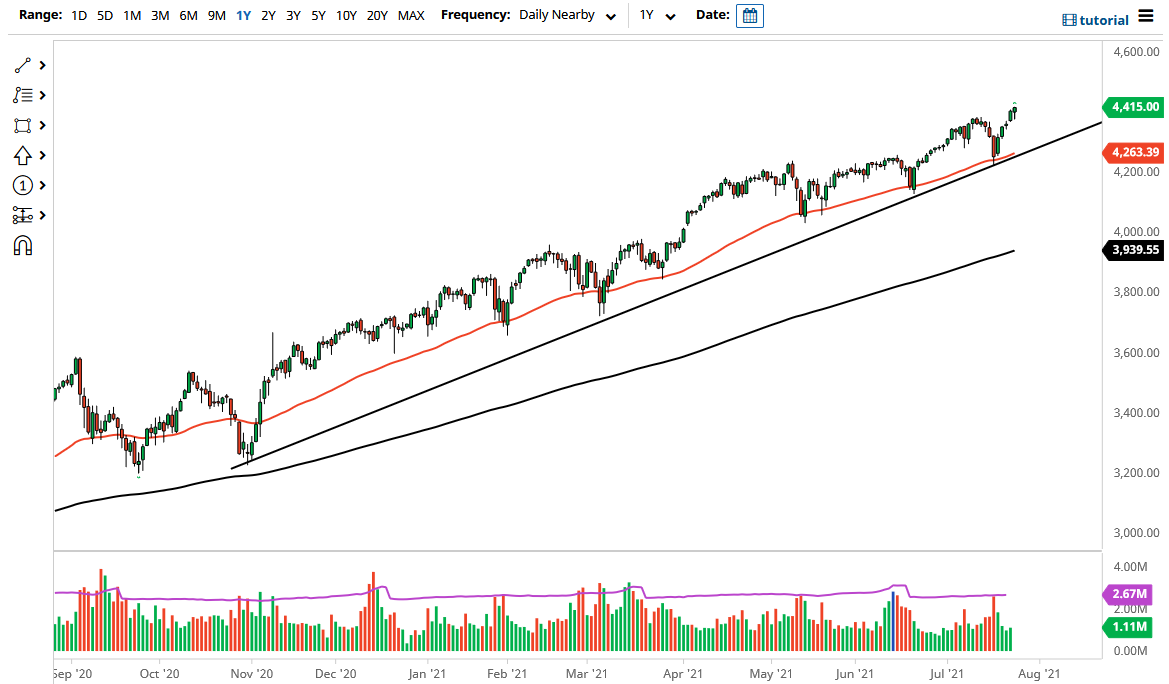

The S&P 500 initially had a little bit of a dip during the trading session on Monday, but then found the 4400 level to be supportive enough to turn things around and form a bullish candlestick. Ultimately, this is a market that is going to continue to go higher regardless of what happens next, because with the Federal Reserve on tap this weekend and the miserable housing numbers, people will be looking at this as an opportunity to simply buy value every time it falls. Jerome Powell will do whatever it takes to keep this market afloat, because that is what he does.

Underneath, we have the 50-day EMA and the uptrend line coming into the picture at 4260, and as a result I think there will be plenty of buyers just waiting to get involved in this market. With that in mind, I am looking for value, but I should also point out that Tesla beat expectations after hours, so it is almost impossible that the S&P 500 will drop, because people are either buying the SPY ETF, or the usual “Wall Street darlings.” I know this sounds lazy, but Wall Street is a lazy place and only looks to a few companies.

If we do get some type of shock to the system, I am more than willing to look for buying opportunities at the first signs of support. However, if we simply break above the top of the candlestick, something I fully anticipate seeing, it would be a sign of strength just getting stronger as we had closed at the very top of the range. At that point, I think the 4500 level is the most logical target. After that, we would go looking the 4600 as the market has since moved in 200-point increments, but I only point out the 4500 level due to the fact that it does have a certain amount of psychology attached to it.

I have no scenario in which I would short this market, but I might consider buying puts below the 4000 level. Needless to say, that is very unlikely to happen anytime in the near term, because that would be about a 12% drop from where we are right now, and it has been a lifetime since we have even seen a 5% drop.