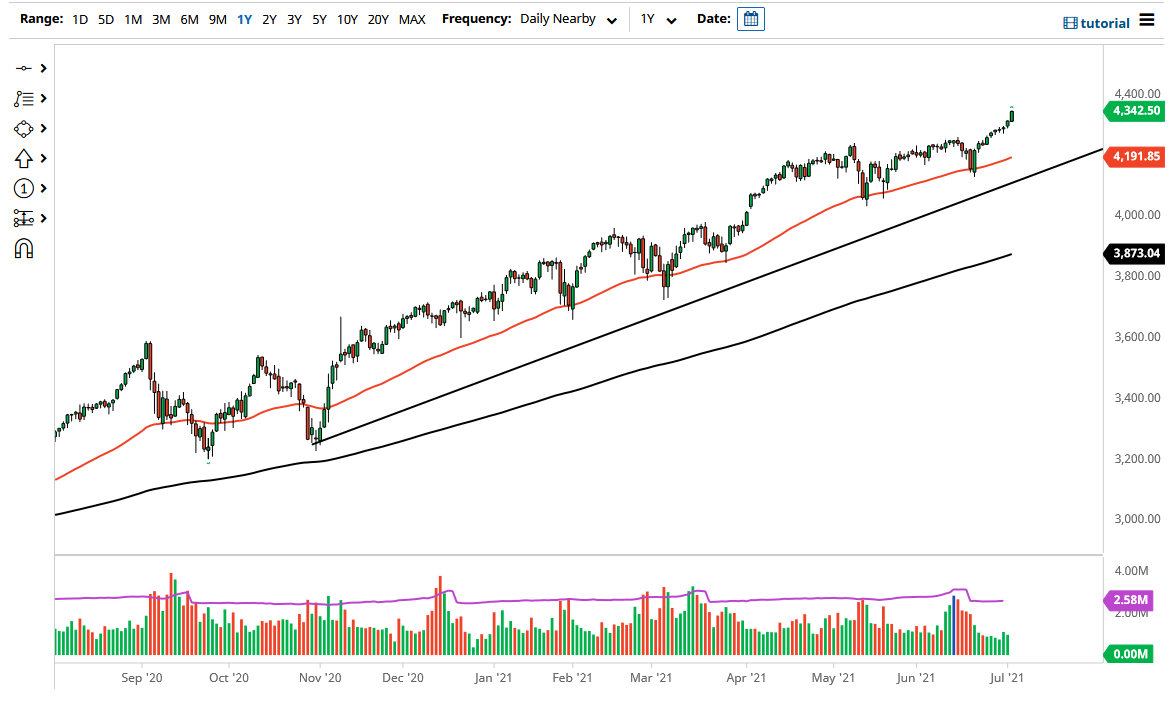

The S&P 500 rallied rather significantly heading into the weekend as the jobs number came out with an addition of 850,000 for the month of June. That shows that the United States is recovering much quicker than many of the other world’s economies, so it makes sense that money would continue to flow into the stock markets in that country. Furthermore, we have been in an uptrend for quite some time, and it is likely that we see continuation given enough time.

To the downside, the 50-day EMA is sitting just below the 4200 level, and that is a large, round, psychologically significant figure. Furthermore, we have an uptrend line underneath that would also offer support for the market. This is a market that tends to move in 200-point increments, so that is something that we need to pay close attention to. With that, the market is likely to go reaching towards the 4400 level, and Friday was certainly another shot in that direction. This is a “buy on the dips” scenario.

We are entering the earnings season now, and that could be a catalyst for markets rising. Short-term pullbacks continue to offer value from everything I see, and there is no reason to believe that this market will change anytime soon, but if we were to break down below the uptrend line, then we could be looking at a move towards the 4000 handle where I see a significant gap and a lot of psychological importance attached to it. If we were to somehow break down below there, something that I do not expect to see anytime soon, that could be a very negative turn of events.

In that scenario, I would be a buyer of puts, but I wouldn't short this market, due to the fact that the Federal Reserve is likely to jawbone the market back up if it falls apart. After all, the Federal Reserve protects Wall Street above everything else, and that is not going to change anytime soon. With this, keep in mind that the central banks are going to continue to flood the markets with liquidity, and therefore stock markets continue to rally.