The S&P 500 initially gapped lower to kick off the trading session on Wednesday but then turned around to fill the gap. At this point, the question is whether or not we are going to continue to see bullish pressure, or if we are going to pull back just a bit in order to find a bit more value. It is the middle of earnings season so we could get the occasional noisy behavior.

At this point, I think the 4400 level is causing a little bit of a headache, but at the end of the day I think it is only a matter of time before we go much higher. After all, we have seen Federal Reserve Chairman Jerome Powell come out during his statement on Wednesday and suggest that perhaps they are going to stay very loose for quite some time. If that is going to be the case, then I think stocks will continue to attract money, because that's how they've been spinning the story for the last 13 years: simply buy stocks because Jerome says it is okay.

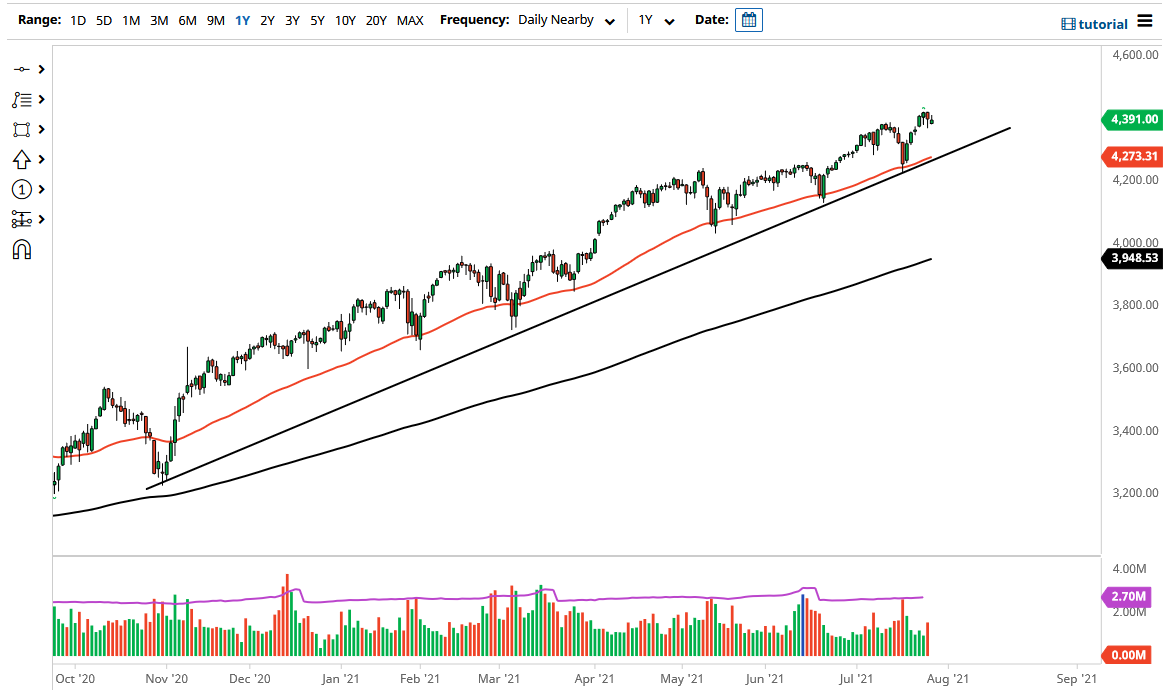

There are no yields to be spoken of when it comes to the bond markets, so most stock traders will be looking to go long based upon that. Yes, people are still buying bonds, but that is for other reasons when it comes to front-running the Federal Reserve and its purchasing program. This is a market that continues to be a “buy on the dips” scenario as it has been for the last several years, and we have the 50-day EMA and the uptrend line underneath offering plenty of support, so with that being the case it is very likely that this will continue to be a scenario where people get involved and try to pick up any signs of value that they get. If we were to break down below the 50-day EMA and the uptrend line, then I might be a buyer of dips, but beyond that I do not really see an argument to get overly concerned. I like the idea of buying the dips, and if we were to break down below the 4200 level, I think the 4000 level is your “floor in the market” going forward.