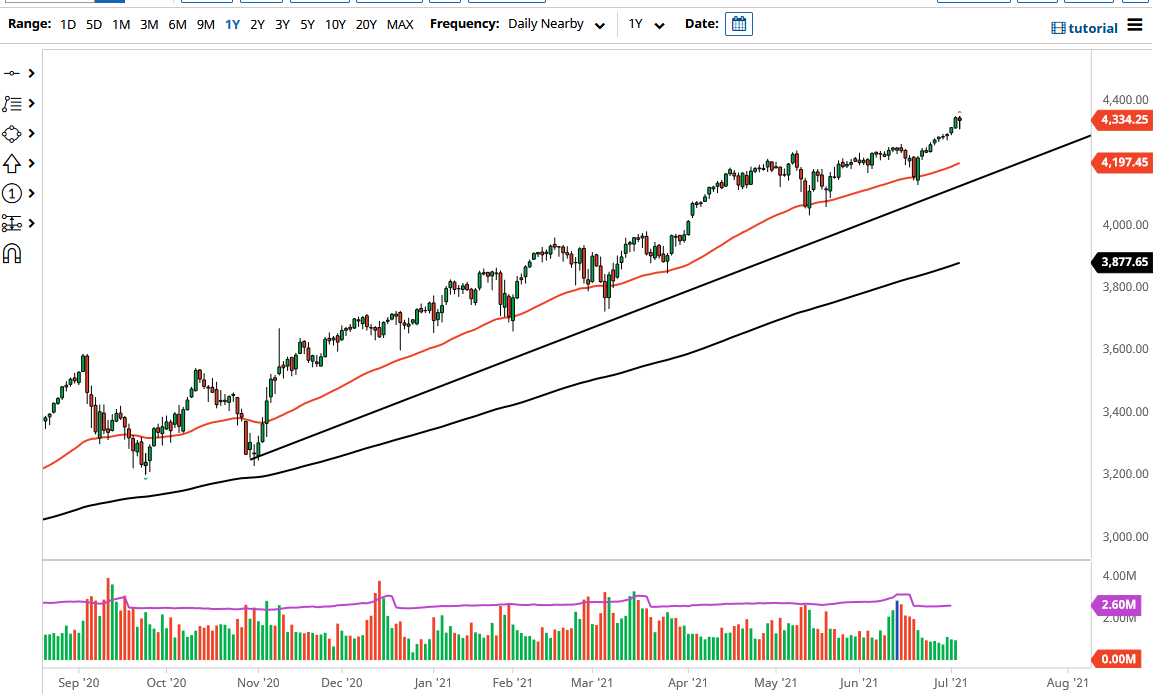

The S&P 500 recovered quite nicely later in the trading session on Tuesday after it wiped out the gains from Friday. That being said, it looks as if the market is ready to continue on going higher and with lower yields, which suggests that people are going to start jumping into the stock market again, if for no other reason than “there is no alternative.” Regardless, we are in an uptrend so there is no point in fighting that battle either. The 4400 level is my target based upon the fact that we tend to move in 200-point increments, and so far, that has held true.

Underneath, we have the 50-day EMA at the 4200 level, but I think it is going to take quite a bit to break down below there, and even if we did, there is also the uptrend line that comes into play. In other words, I believe this is a “buy on the dips” market, but I also recognize that we are moving away from value and into growth, so I still prefer the NASDAQ 100 over the S&P 500 at this point. Regardless, both indices should continue to go higher, and you certainly cannot be a seller of stocks as the liquidity measures alone force them higher.

To the upside, the 4400 level is my target based upon the 200-point increments, but I think we will go higher than that. I would anticipate that the 4500 level offers a bit of resistance though, if for no other reason than simple psychology. If the NASDAQ 100 can break above the 15,000 level, then clearly the S&P 500 should be able to continue going higher as it would simply drag this index up with it. The US dollar has strengthened as of late, but I think that comes down to the bond market and perhaps money flowing into the US indices, so perhaps then they can rise in value at the same time, assuming that the US dollar does not suddenly spike to the upside. If it does, that could be a bit of a headwind, but there are no real concerns about that at the moment, and clearly the path of least resistance in the S&P 500 is to the upside. Continue to look for value and then take advantage of it.