The S&P 500 has fallen during the course of the trading session on Thursday as yields in America have continued to fall. Because of this, there is a general fear trade going on at the moment, and that of course suggests that perhaps we are focusing more or less on the possible lockdowns that could happen around the world. After all, we have seen Tokyo and Australia both close down, and that could lead to bigger things, at least as with the narrative is during the trading session on Thursday. That being said, as money flows into the bond markets, that typically suggests that it will flow out of the stock market.

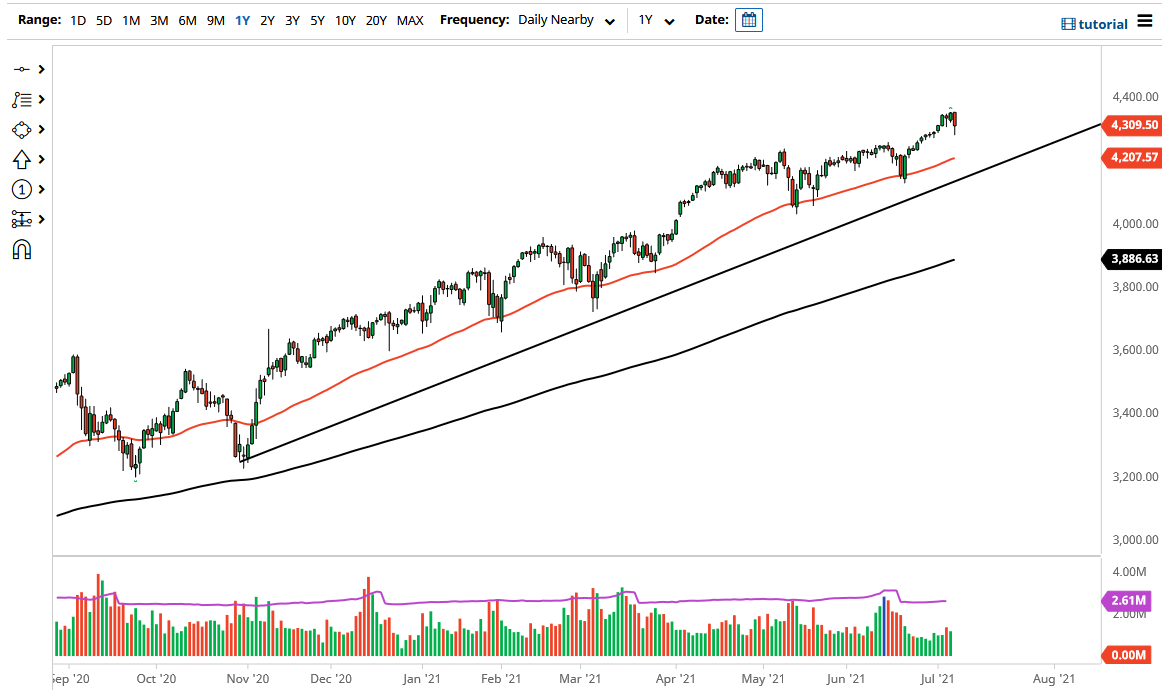

The 50 day EMA is currently at the 4207 level and should offer a certain amount of support based upon the fact that it is a widely used technical indicator, and of course a lot of people use it to define the overall medium-term trend the uptrend line is just below there, and in also should see plenty of support near the 4000 level as well, as there is a bit of a gap in that general vicinity. It is not until we break down below the 4000 level that I would be concerned, and quite frankly even though we did sell off quite drastically during the session, that does not look likely to happen anytime soon.

The alternate scenario of course is that we simply turn around a break above the top of the candlestick for the session and head into the weekend positive. If that is the case, that would be a very strong sign and it is likely that we would go quite a bit higher. At that point, I would anticipate that a move to the 4400 level is more likely than not, as the pair does tend to move in 200 point increments. Breaking above there then would open up the possibility of a move 4600, but I think it also makes quite a bit of sense that the 4500 level probably causes noise based upon the fact that it is a “midcentury mark.”

If we do break down below the 4000 handle, I might be a buyer of puts, but that is about as negative as I would get with this market, as the Federal Reserve will certainly react if things get far too bearish anytime soon.