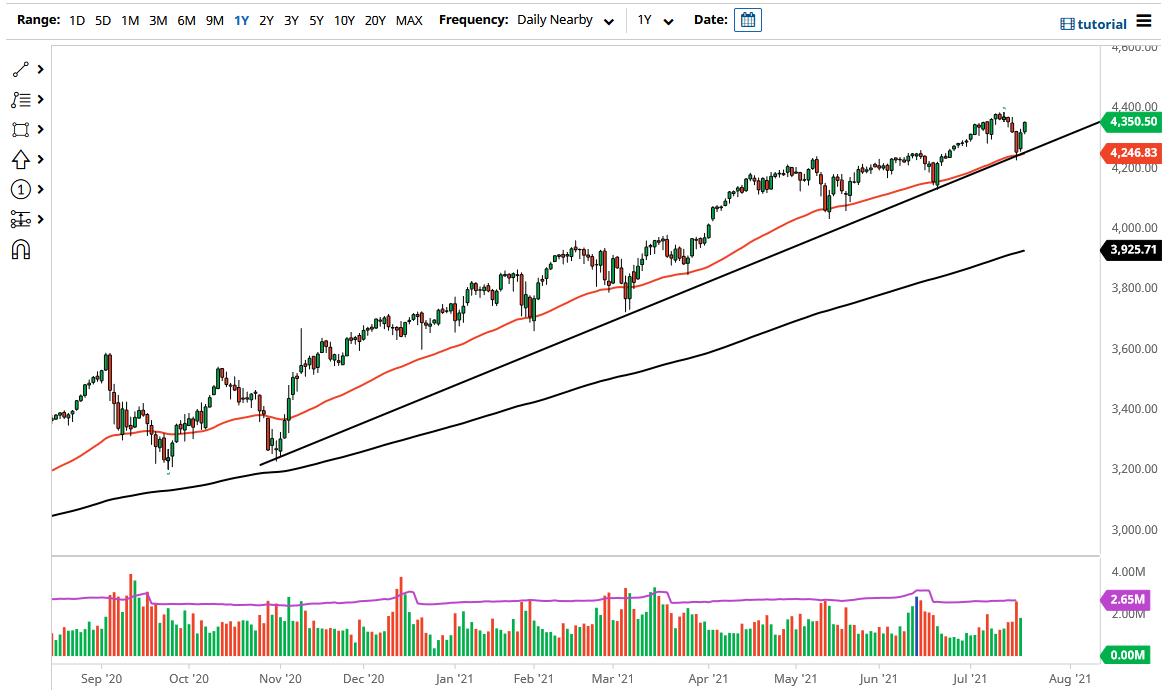

The S&P 500 rallied significantly again during the trading session on Wednesday as we continue to see the S&P 500 rally under any circumstances imaginable. Yes, we had a major selloff over the last couple of days, but as per usual, the plunge protection team came in and picked things up. We bounced from the 50-day EMA and the uptrend line, reaching towards the 4350 level. At this point, the market is likely to see more of a “buy on the dip” attitude going forward, as we can see so much in the way of manipulation by the Federal Reserve and the idea of the “reflation trade” coming into the forefront.

To the upside, the 4400 level above is a significant target, and I do think that given enough time we could see the market target that level as the S&P 500 continues to see 200-point increments being played. The market will more than likely break above the 4400 level given enough time as we have so much in the way of easy money, and then go looking towards the 4500 level, which is a large, round, psychologically significant figure as well.

Underneath, if we were to break above the uptrend line and the 50-day EMA, then the market is likely to go looking towards the 4200 level followed by the 4000 level underneath, as it is a large, round, psychologically significant figure and an area that I think a lot of people will be paying close attention to. There is a gap there, so that obviously comes into the picture as well, especially as the 200-day EMA will be approaching that level as well. If we break down below that level, then I might be interested in buying puts, but beyond that I would not get very bearish.

Over the longer term, it would only be a matter of time before the Federal Reserve steps in and saves Wall Street if we do break down below the 4000 handle, so given enough time I believe that would have a nice longer-term “buy-and-hold” trade if that does happen, but a move to the 4000 level might be acceptable as it would simply be a 10% correction, something that is quite common for the market over the longer term. Nonetheless, this is a market that I think will continue to go higher over the longer term.