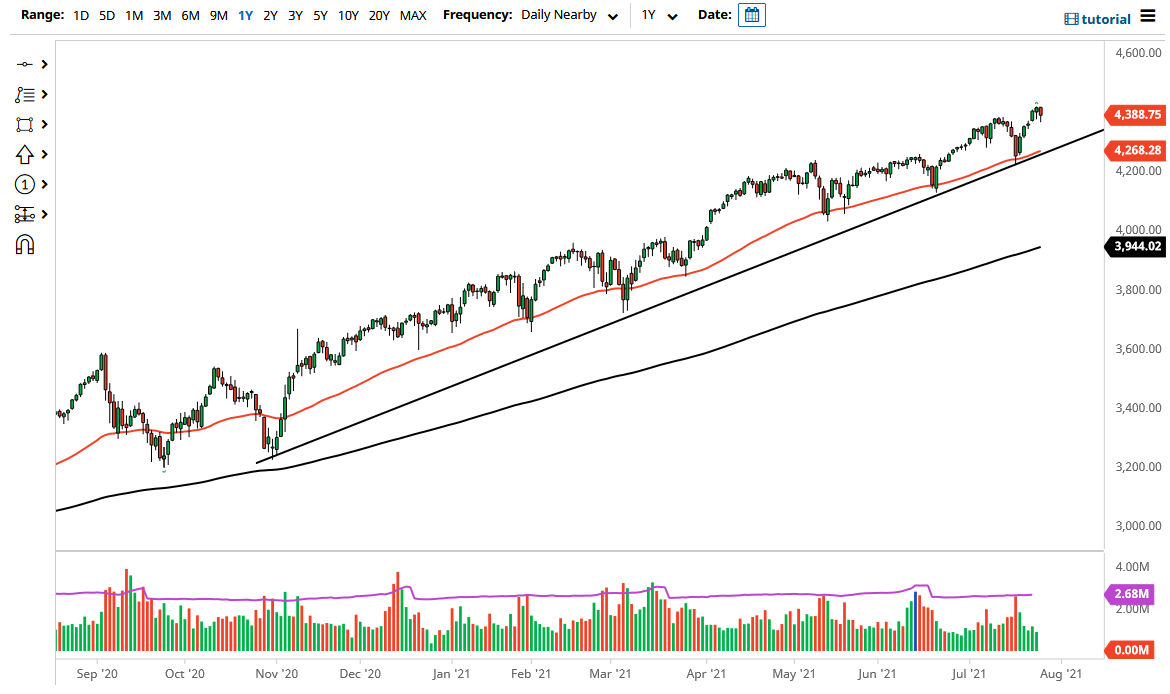

The S&P 500 pulled back during the trading session on Tuesday to reach towards the 4350 level. However, we bounced a bit in order to show signs of stability, which suggests that we could continue to find buyers on dips. Keep in mind that the Federal Reserve is likely to stir things up as they have a meeting and a statement during the day, and as a result, the markets will be paying close attention to what the chairman has to say, as well as the idea of whether or not the Federal Reserve is going to be loose with monetary policy going forward. Here is a hint: they will.

To the downside, the 50-day EMA sits right above the uptrend line, and I think it makes sense that there would be plenty of buyers looking to get involved as the market should continue to offer value on these dips. Even if we were to break down below this uptrend line and the 50-day EMA, there is not really a scenario in which I would consider shorting this market.

If we do break down significantly, the 4200 level offers a little bit of support, followed by the 4000 level which is a large, round, psychologically significant figure, and the scene of a gap that should offer support. The 200-day EMA is sitting right around the 4000 level as well, and as a result I think there will be a significant amount of support in that area due to options barrier traders, and the overall uptrend being defined by the 200-day EMA. If we were to break down below there, then it is likely that we would be buyers of puts more than anything else, because it is almost impossible to short this market.

To the upside, if we were to break out, I believe that the market will go looking towards the 4500 level, possibly even the 4600 level, as the market tends to move in 200-point increments. But in general, this is a market that only goes long over the longer term, so there is no point in fighting it. Jerome Powell has had issues in the past when saying the wrong thing as stock markets will sell off, but ultimately, he cracks his “mistake” and does whatever it takes to lift Wall Street up again.