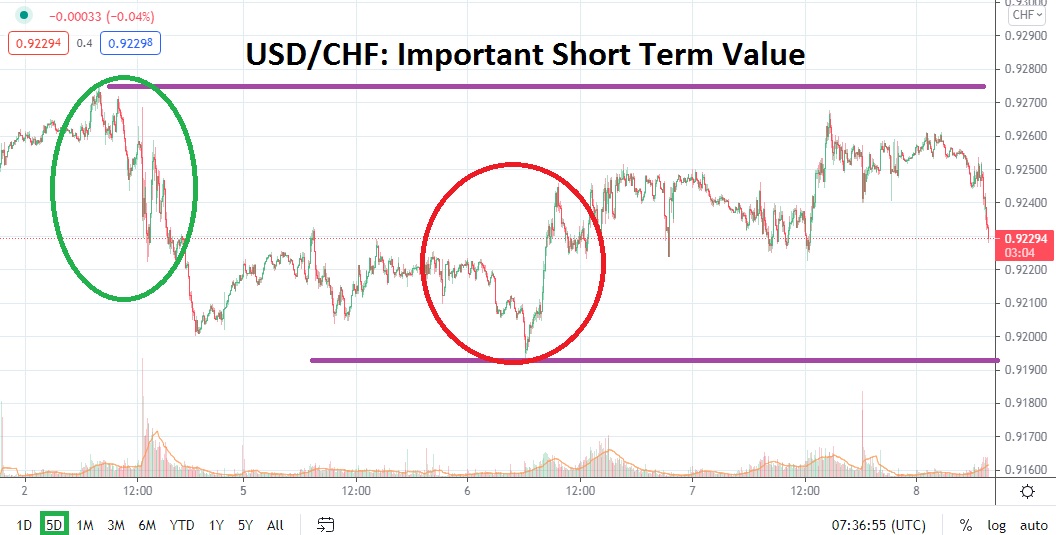

The USD/CHF is trading near the 0.92000 juncture in early trading this morning, and this value has proven to be a catalyst the past five days via technical considerations. The USD/CHF has seen solid bullish momentum since the 11th of June, when the Forex pair was trading near a low of 0.89300. Since the 16th of June, the USD/CHF has seen a strong move higher, and on the 2nd of July, the USD/CHF hit the 0.92730 ratio. The high was attained as financial houses situated their cash positions in the midst of the U.S jobs report last Friday.

After testing that high, which was last traded on the 12th of April previously, the USD/CHF fell to nearly 0.91900 on the 6th of July. The moves within the USD/CHF must be examined through the lens of a conservative perspective; the movements may not appear to be volatile, but this depends on the amount of leverage a trader is using. Current support for the USD/CHF appears to be 0.91700 to 0.91550 and, if these marks falter, it may indicate further bearish momentum could emerge.

Bullish speculators may continue to believe additional surges higher can be produced, but speculative bears may be proven correct if they believe that via risk/reward scenarios there is a greater chance for substantial downside movement compared to the upside. Important resistance appears to lurk near the 0.92500 mark, if this level is challenged, yes, another test of higher values may be seen. However, there is reason to suspect these higher levels would run out of power.

The short term has certainly seen a substantial bullish run higher for the USD/CHF, but if speculators believe the Forex pair is valued too highly and downward momentum will be generated, now may prove to be an opportunistic time to test current values. If the USD/CHF starts to sustain its value below the 0.92000 juncture, this may indicate that the forex pair is ready to test the 0.91700 juncture sooner rather than later. Traders need to use risk management within the USD/CHF astutely and practice solid risk management, because small moves within the Swiss franc can add up quickly or become costly in fast bursts.

Swiss Franc Short-Term Outlook:

Current Resistance: 0.92200

Current Support: 0.91700

High Target: 0.92500

Low Target: 0.91350