Signs of tightening the bank's policy soon will support the dollar's gains against the other major currencies. The price of the USD/JPY currency pair jumped to the resistance level of 110.70 this morning, before settling around the level of 110.44 at the time of writing the analysis.

Prices for US consumers jumped in June by the most in 13 years, evidence that a rapid recovery in spending has coincided with widespread supply shortages escalating the costs of many goods and services. Yesterday's report from the Labor Department showed that US consumer prices in June rose 0.9% from May and 5.4% over the past year - the largest year-on-year rise in inflation since August 2008. Excluding volatile oil and gas prices, so-called core inflation rose by 1.5%. 4.5% last year, the largest increase since November 1991.

The rebound in inflation, which coincided with a rapid economic recovery from the pandemic recession, is likely to intensify the debate at the Federal Reserve, and between the Biden administration and Republicans in Congress about the extent to which the accelerated price increases will continue. The Fed and the White House have made clear their belief that the current wave of inflation will be temporary. They suggest that as supply chain bottlenecks resolve and the economy returns to normal, soaring prices for items such as used cars, hotel rooms and clothing will fizzle out. Some economists, along with Wall Street investors, have indicated they agree.

Commenting on this, Jos Foucher, an economist at PNC Financial Services, said: "The headline inflation numbers have been striking in recent months, but core inflation remains under control." "Once again, some categories - used cars, airline tickets, rental cars, hotels - are seeing huge price gains due to the recovery from the pandemic," he added.

However, persistently high inflation increases the possibility that the Fed will decide to act sooner than expected to roll back its ultra-low interest rate policies, which are intended to support more borrowing and spending. If so, that would weaken the economy and potentially derail recovery. Currently, the price increases are ahead of the wage gains that began this year, which means the financial burdens on millions of families are becoming more difficult. Average hourly earnings increased 3.6% in June from a year earlier, typically a solid gain, but well below current inflation.

Low-income workers are also hit hard by rising food prices, which rose 0.8% in June, and gas costs, which rose 2.5% last month and 45% from a year ago. One reason annual inflation readings are now so high is that recent prices are being measured against the sharp price drops that followed the pandemic in March of last year. This statistical distortion began to fade in June and will no longer be a factor when annual inflation figures for July are released next month.

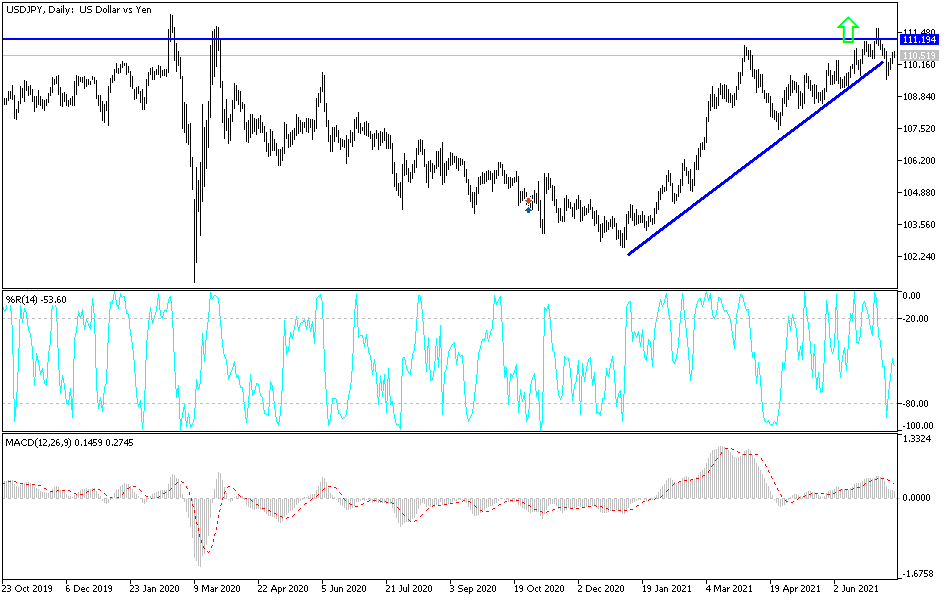

According to the technical analysis of the pair: The adherence of the USD/JPY currency pair to move around and above the psychological resistance 110.00 will continue to support the general upward trend. Technical indicators on the daily time frame still have the opportunity to achieve stronger gains before they reach strong overbought levels and may give signals for that with the bulls crossing the resistance price 111.35. The currency pair is still in the range of an ascending channel and I still prefer buying the pair from all over the world. The closest support levels for the pair are currently 110.15, 109.65 and 108.80. The last level is confirmation of the turn of the trend to the downside and the start of bears' control.

Ahead of the testimony of US Federal Reserve Governor Jerome Powell, the producer price index reading in the United States will be announced, one of the tools for measuring inflation in the country.