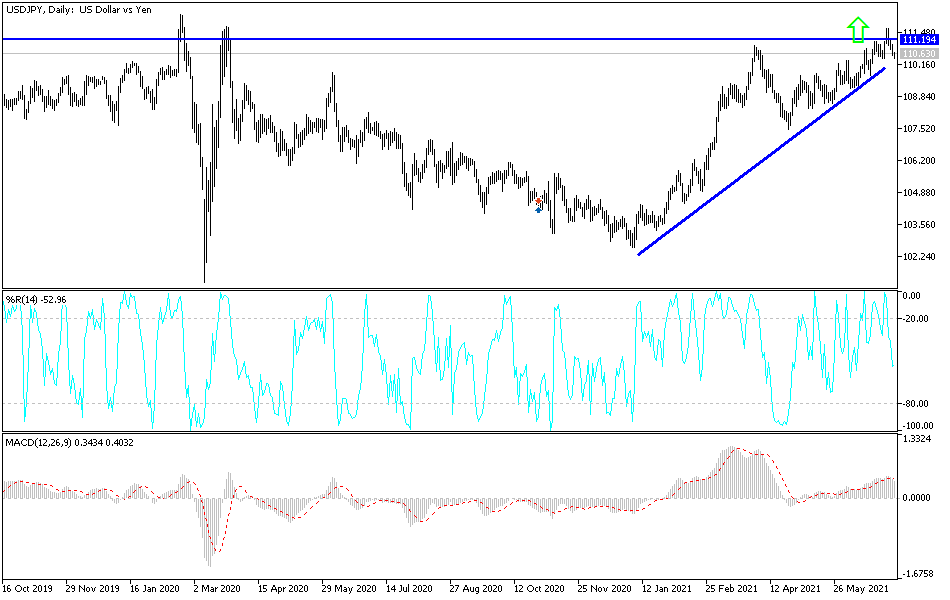

For the fourth day in a row, the USD/JPY currency pair is exposed to profit-taking operations, but has not yet escaped from its ascending channel. The pair is stable around 110.40 at the time of writing the analysis. Its recent strong gains reached the resistance level 111.66, the highest since March 2020. This is in light of the strength of the US dollar against the rest of the other major currencies, amid increasing expectations of the imminent date of raising US interest rates. Regarding this, the currency pair will be exposed to some fluctuations today. The forex market awaits the announcement of the minutes of the last meeting of the Federal Reserve for the month of June, which carried clear indications of the extent of confidence in the US economic performance, which paves the way for tightening the monetary policy of the bank.

Growth in the US service sector, where most Americans work, slowed in June after record growth in May. In this regard, the Institute of Supply Management said that the monthly survey of the ISM service industries fell to a reading of 60.1, after an all-time high of 64 in May. Any reading of the index above the 50 level indicates that the sector is growing. Therefore, it is the thirteenth consecutive month of growth in the services sector after a two-month contraction in April and May of last year as companies were forced to close during the early stages of the Corona virus pandemic.

After five consecutive months of growth, the employment index fell into contraction territory in June with a reading of 49.3, down from 55.3 in May, indicating that many companies are still struggling to hire enough workers.

Recently the US Labor Department reported an encouraging boost in employment in last week's jobs report, with 850,000 jobs added in June, well above the average of the previous three months. Employment in June was particularly strong in restaurants, bars and hotels, which collectively absorbed the heavy layoffs from the recession. These companies added 343,000 jobs, but it may not be enough.

Respondents' comments continued to focus on supply chain issues, supply shortages, and staffing difficulties.

One group that benefits from abundant jobs is teenagers. A severe labor shortage - particularly in restaurants, tourism and entertainment - is driving up the demand for teenage workers. Lifeguards, bus tables and other jobs pay $15 to $17 or more in many places, drawing young people into the workforce in numbers not seen since before the Great Recession. The Department of Labor also says 33.2% of Americans ages 16 to 19 are working, the highest percentage since 2008. Although that number decreased slightly in June, it is still higher than the previous figure for the pandemic.

New US manufacturing data released last week showed that demand has continued to be so strong that companies are struggling to keep pace with orders. Supply chain shortages and difficulty finding enough workers have contributed to order backlogs and delivery delays in the manufacturing sector. The story is similar in the services sector, where delivery times have improved but are still slow. Backlogs of orders also built up in June, with the index rising to 65.8 from 61.1 as companies continue to struggle to keep up with demand.

According to the technical analysis of the pair: The recent selling operations did not break the USD/JPY currency pair from its ascending channel, and this will not happen as a first stage without breaching the 109.75 support level. On the other hand, as I mentioned before, the pair’s return to move above 111.20 confirms a stronger control of the bulls on performance and at the same time will push the technical indicators to overbought levels. The pair's current gains will face the most important event for this week, the announcement of the contents of the minutes of the last meeting of the Federal Reserve.