The USD/JPY currency pair is stable around the resistance level 110.45 at the time of writing the analysis. The sharp selling recently pushed it towards the support level 109.53 . The pair's trajectory this week will be affected by the announcement of US inflation figures and the testimony of Federal Reserve Governor Jerome Powell before Congress, waiting for clues about when the US central bank may begin to reduce its asset purchases.

Powell is scheduled to give his semi-annual testimony in Congress on Wednesday.

Investors are also watching the news regarding the spread of the delta type of coronavirus in several parts of the world. G-20 finance ministers warned over the weekend that global economic growth was at risk from rising novel coronavirus variants and lower vaccine availability in developing countries. In this regard, the head of the World Health Organization called on drug manufacturers to prioritize providing poor countries with their own COVID-19 vaccines rather than pressure on rich countries to use more doses, just as some preparations are seeking permission for a third dose to be used as a booster in the face of virus variants.

At a press conference on Monday, the head of the World Health Organization, Tedros Adhanom Ghebreyesus, said the huge disparity in vaccines between rich and poor countries means that we are "making conscious choices right now not to protect those in need." He said the priority now should be to vaccinate people who did not receive doses.

Tedros called on Pfizer and Moderna to "make every effort to provide COVAX, the task force on vaccine acquisition in Africa and low- and middle-income countries with very little coverage," referring to the UN-backed initiative to distribute vaccines globally. Pfizer and Moderna agreed to supply small amounts of their vaccine for COVAX, but the vast majority of their doses were booked by rich nations.

Last week, Pfizer said it would seek permission to obtain a third dose of its COVID-19 vaccine, saying a booster dose could significantly boost immunity and possibly help stave off worrisome variables.

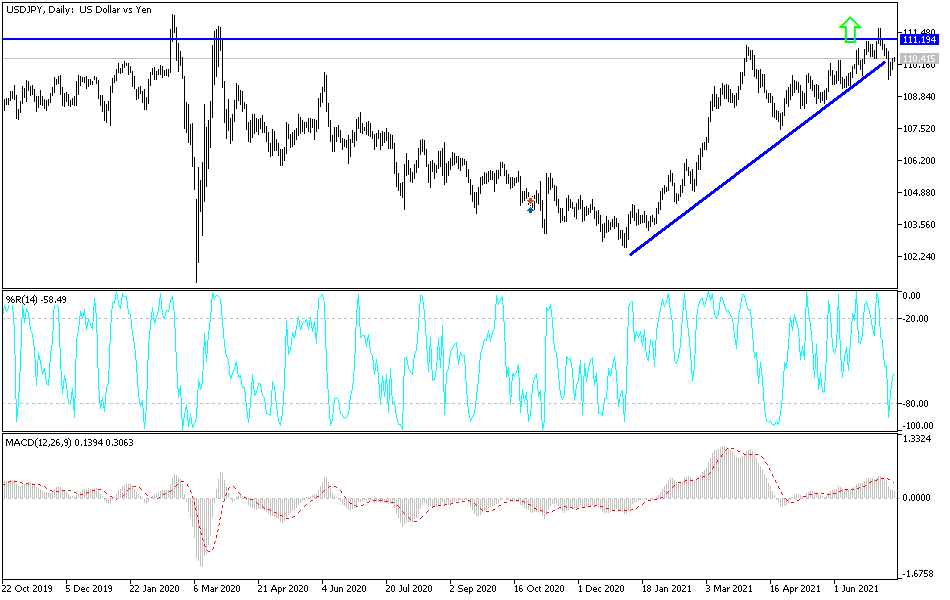

According to the technical analysis of the pair: Continuing expectations of imminent tightening of the monetary policy of the US Federal Reserve and improving the results of US economic data will remain factors supporting the bullish trend of the USD/JPY currency pair. This is especially if it remains stable above the 110.00 psychological resistance that stimulates the bulls for more buying deals. Thus, the currency pair pushed towards stronger resistance levels, the closest to it currently are 110.85, 111.35 and 112.00. On the other hand, the pair will abandon those expectations if it moves below the 108.85 support level. I still prefer buying the pair from every bearish level. The currency pair will be affected today by the release of US inflation figures, the Consumer Price Index.