The bears had the opportunity to push the price of the US dollar/JPY currency pair to the 109.58 support level before settling around level 109.85 at the time of writing the analysis. The bank's signals will be important for the dollar pairs and determine the path for the end of July trading. US Federal Reserve Governor Jerome Powell will provide updated guidance on plans to reduce extraordinary monetary support for the economy in an era of crisis. Analysts tend to point out that the Fed will confirm that they intend to scale back their quantitative easing program in the coming months, a necessary prelude to higher interest rates, steps that prove the dollar's support.

However, there are new downside risks for the US currency as the Federal Reserve may have to tackle the growing US coronavirus issues courtesy of the Covid Delta that has gained a foothold in the country.

The Federal Reserve was responsible for the noticeable rise in the dollar's value during the months of June and July after it delivered a more optimistic tone about the US economic outlook and any easing of this optimism would be reversed by the markets. Commenting on this, Derek Halpini, Head of Research for Global Markets at MUFG said, “The US dollar strengthened on the back of the Fed's hawkish policy surprise at the FOMC meeting in June. The policy announcement created a negative market reaction by introducing expectations of a Fed rate hike, thus raising short-term US interest rates and encouraging a strong US dollar.”

The July meeting coincides with a sharp rise in Covid cases around the world which in turn has raised investor concerns about global growth trends, which have proven to support the dollar so far as the currency has benefited as investors sought safe haven assets. These win-win dynamics (tight Fed + global safe-haven demand) for the dollar could weaken if the variable starts to raise cases in the US, which it appears to be doing now. If the Fed takes more caution on the economic outlook of the economy due to the diversity of investors, it is likely that they will backtrack on their timing for the first rate hike, which in turn will affect the dollar.

The July meeting comes ahead of Powell's speech at the annual Jackson Hole event scheduled for the end of August, where major policy changes have been announced in the past. The market is expecting the Federal Reserve to issue a signal on Wednesday that more significant guidance on “scaling back” quantitative easing is coming.

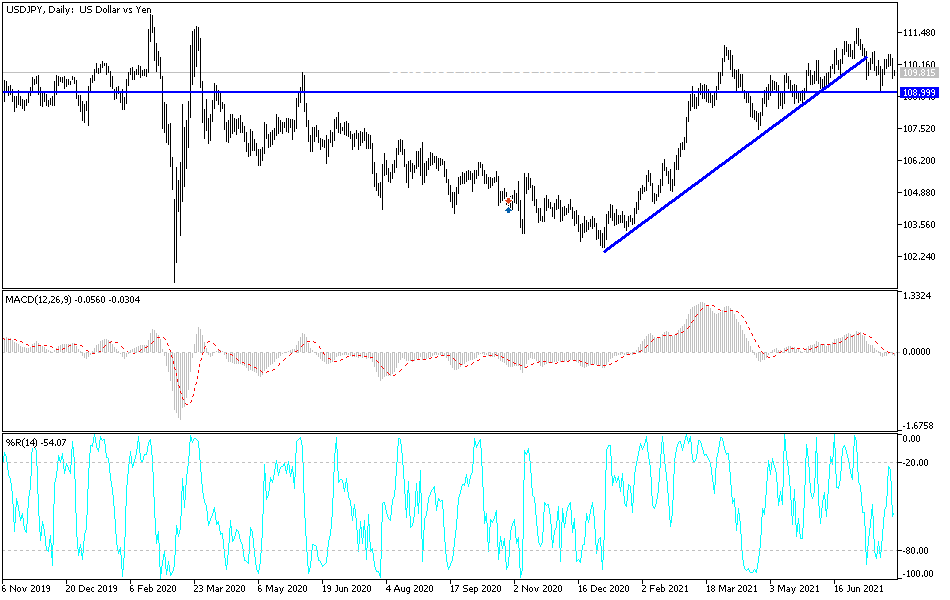

According to the technical analysis of the pair: There is no doubt that the move of the USD/JPY currency pair below the psychological resistance 110.00 threatens the bulls’ control over the performance and pushes the currency pair to stronger support levels and the closest to it is currently 109.55 and 108.80, respectively. In general, I still prefer buying the currency pair from every bearish level. On the other hand, investor confidence improved after the US Central Bank’s announcement, its policy statement and Governor Powell’s statements, that the currency pair will launch to the resistance 111.20 again, which is the most important level for the bulls.