As a result, the USD/JPY currency pair continued its downward correction to the 109.67 support level in morning trading on Thursday. The spread of the COVID-19 variant delta has increased infections, prompting some companies and governments to order vaccinations and raising concerns about the recovery of the US economy.

Yesterday, Federal Reserve Chairman Jerome Powell inserted a letter of reassurances, indicating that the delta variable does not pose a significant threat to the economy, at least for now. “What we've seen is with successive waves of COVID over the past year and some months now,” Powell said in his press conference, and “there has been less bias in terms of the economic impacts of each wave. We'll see if that's the case with Delta injuries, but it's certainly not an unreasonable expectation.”

The decline in the pace of bond-buying by the US central bank, which is likely not to start until the end of this year or early next year, will mark the beginning of a gradual decline in the Fed's support for the US economy. Only when the bond buying is complete is the Fed expected to start considering raising the benchmark interest rate from zero, which it has been since the pandemic broke out in March of last year.

Also at his press conference, Jerome Powell acknowledged that the rapid spread of the highly contagious delta variant was threatening some areas of the country where vaccinations are low, and noted that "some expectations for them are going to go up dramatically." As the virus spreads, he said, some consumers may pull back from the spending that prompted a rapid recovery from the pandemic recession. We may see economic effects from some of that or it may affect the return to the labor market. We don't have a strong sense of how that works, so we'll be watching that carefully.”

Powell noted that last summer's wave of infections did less damage to the economy than many analysts had expected.

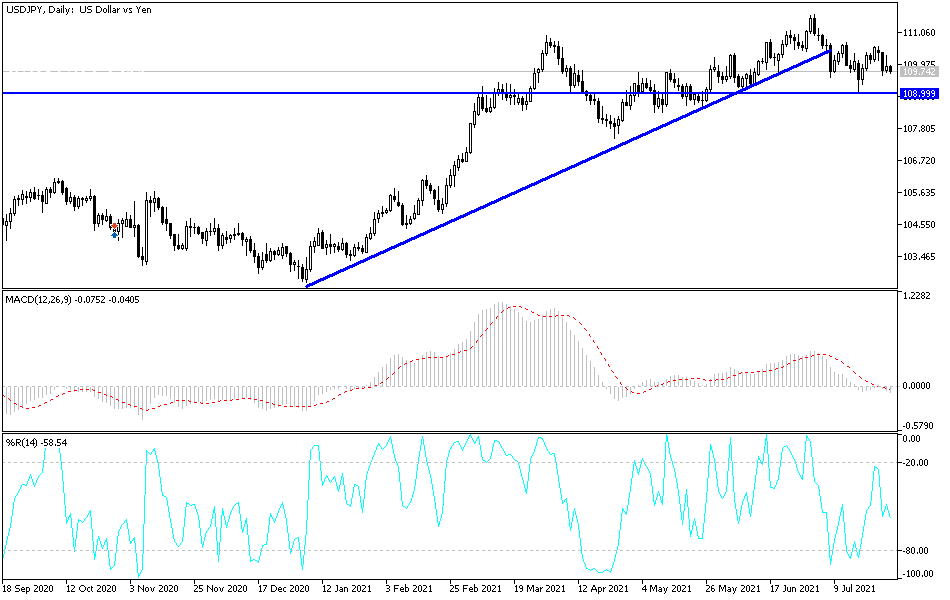

According to the technical analysis of the pair: Forex investors still abandoned the psychological resistance level of 110.00 for the USD/JPY currency pair, which supports the downward correction.

According to the performance on the daily chart, the technical indicators have not yet reached oversold levels, which means the pair is ready for selling operations to move towards stronger support levels. The closest to them currently are 109.25 and 108.80, and the last level is strong for the bears’ comprehensive control of the currency pair. For the bulls to control the performance, the currency pair needs to move towards the resistance levels 110.35 and 111.20. I still prefer buying the currency pair from every bearish level.

The currency pair will be affected today by the extent to which investors take risks or not, as well as the reaction of the dollar to the announcement of the growth rate of the US economy and the number of weekly jobless claims