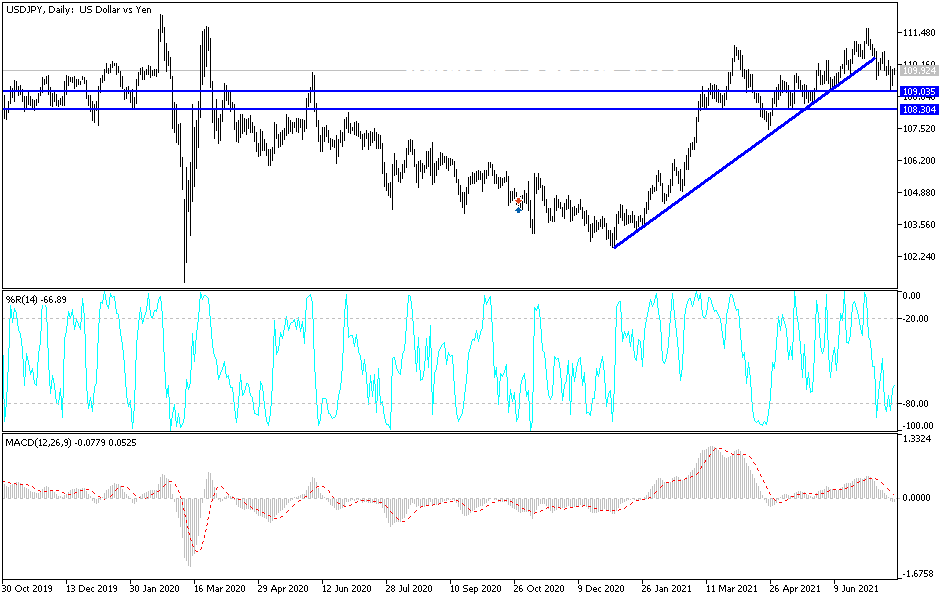

This was to prevent the bears from strengthening the control of the currency pair, as they moved to the 109.06 lowest support level for nearly a month at the beginning of this week's trading.

The currency pair is stabilizing around the 110.12 level at the time of writing the analysis, since the beginning of the week’s trading. The focus of forex investors remains on the increasing global infections again with the Corona virus and the return of containment restrictions that threaten the future of the global economic recovery, and thus the increased demand for safe havens.

The Japanese yen is struggling to determine the direction as rising inflation and tightening US central bank policy have affected safe-haven assets. The Japanese Yen was one of the worst performing Asian currencies yesterday, although it tried to bounce back over the past month. Interacting with the surge in COVID-19 cases and their impact on sluggish economic growth, the second half could be tough for the yen.

According to the Ministry of Internal Affairs and Communications, consumer prices in the country rose at an annual rate of 0.2% in June, up from a 0.1% decline in May. This represents the first annual growth since August last year. Most of the upward pressure in prices is concentrated on housing, furniture, entertainment, and education. This has been offset by a decline in transportation, communications, and medical care. Last month, core consumer prices, which exclude the volatile food and energy sectors, rose for the second month in a row to 0.2%. This was the fastest annual growth in more than a year, highlighting how global commodity inflation is affecting the world's third-largest economy.

On a monthly basis, the Consumer Price Index (CPI) advanced 0.3%.

The question now is: Do decision makers care about the national economy? Tokyo maintained its overall assessment for the second month in a row, as Japanese Prime Minister Yoshihide Suga and his cabinet indicated that coronavirus infection trends could negatively affect both domestic and international economies. However, Tokyo expects business conditions to improve. In the second quarter, the Japanese economy stagnated, and the government is due to release a preliminary estimate of GDP from April to June next month.

Meanwhile, the Bank of Japan (BoJ) trimmed its growth forecast for the fiscal year, stressing that the latest public health and emergency restrictions to combat the coronavirus pandemic will weigh on consumption and enable the view that Japan will lag behind other advanced economies. Moreover, the Bank of Japan released a list of actions it will take to tackle climate change, including buying green bonds. For his part, Bank of Japan Governor Haruhiko Kuroda said: "The Japanese economy is likely to recover gradually as vaccinations advance and the impact of the epidemic declines." Aside from what governments and parliaments do, we've discussed what central banks can do on this front. The biggest problem was how much we should do as a central bank, and what we could do.”

According to the technical analysis of the pair: The stability of the USD/JPY currency pair, above the psychological resistance 110.00, it is still the most important for the bulls to perform. Therefore, it is moving towards stronger ascending levels, the closest to them currently is 110.35 and 111.20. The last level is confirmation of the return of the trend upwards. To the downside, the most important support 108.80 will remain for the bears to control again. The currency pair does not expect any important and influential economic data today, and investor sentiment will be the risk appetite or not, the factor influencing the currency pair's trends today.