The rebound gains did not exceed the 110.70 resistance level, but the bears soon returned to control the performance. The pair retreated to the 109.75 support level, which is stable around it at the time of writing the analysis. The US dollar's gains were halted against the other major currencies. After the Fed chair reiterated his long-held view that high inflation readings over the past several months were largely driven by transitory factors, notably supply shortages and increased consumer demand as business restrictions linked to the pandemic are lifted.

However, House members have thrown questions about rising inflation in recent months, with some expressing concern that prices will continue to accelerate. The Fed chair replied that the central bank would not respond to short-term price hikes by raising interest rates and risk weakening the economic recovery.

"With inflation, year after year, year after year, we mean prices go up," Powell said. “And if there is something that is a one-time increase in prices … you will not interact with something that is likely to go away.” "We really believe, these things are going to come down on their own," he added.

Powell's comments coincided with growing concerns, among economists and ordinary families, that rising inflation pressures are creating a burden on many people and posing a potential threat to recovery from the pandemic recession. Yesterday, the government said wholesale prices, which are paid by companies, jumped 7.3% in June compared to the previous year. This was the fastest 12-month increase in records dating back to 2010.

The US central bank said it will keep the benchmark short-term interest rate steady near zero until it believes maximum employment has been reached and annual inflation has moderately exceeded 2% for some time. Central bank policy makers have said they are prepared to accept inflation above its target to offset years of inflation below 2%. Powell added yesterday that the economy is "still a long way off" from making the "more significant progress" that policymakers want to see before they start reducing their $120 billion monthly bond purchases. These purchases are intended to keep long-term borrowing rates low to encourage borrowing and spending.

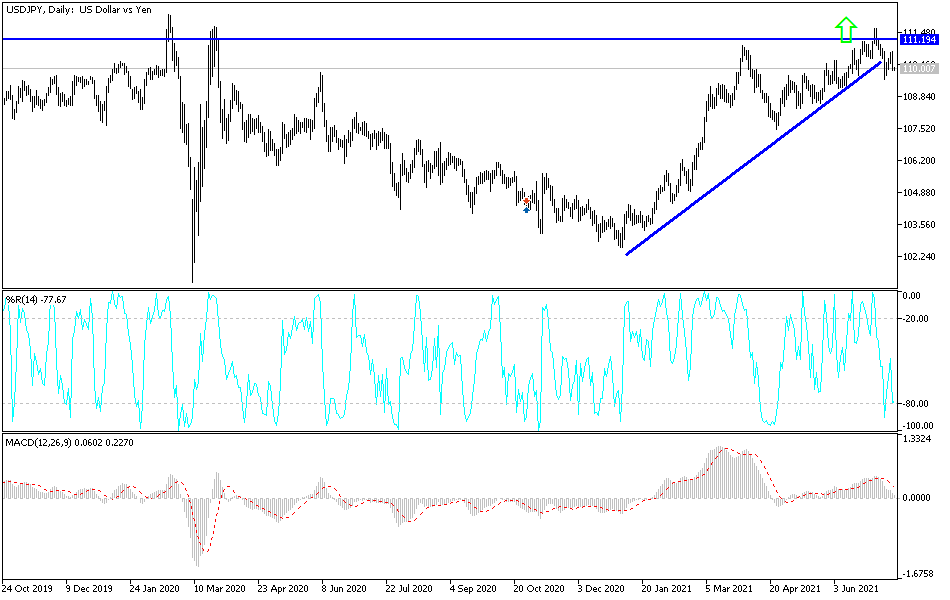

According to the technical analysis of the pair: The return of the stability of the USD/JPY currency pair below the 110.00 level will increase the chances of the bears controlling the performance and thus activating more selling operations. The second and third level confirm the transformation of the general trend to the downside. On the other hand, the return of the dollar-yen currency pair to the resistance area 111.20 will return it to the path of the strong upward trend.

The currency pair will be affected today by the risk appetite of investors, as well as the reaction from the jobless claims announcement, the Philadelphia Industrial Index reading and the second testimony of Federal Reserve Governor Jerome Powell.